JAMES ‘WOODY’ WOODBURN

Hi, welcome to ‘Invisible Edge 2022’ and thanks for giving us your time this evening.

I’m James Woodburn from Fat Tail Investment Research…

And you’re in for a real treat tonight.

Over the next hour, you’re going to discover a quick and easy way to get pro-level monitoring and alerts across all the stocks in your portfolio.

Alerts that can help you determine when to sell your shares, and when to buy back in…

Suggest how many shares to buy in any one company…

And help you balance your risk across your entire portfolio…no matter how many Fat Tail services you subscribe to.

This is going to take SO much work, stress, and effort off your plate — it really is so simple…and, right now, so NECESSARY too.

Better still, the results of doing what I’m about to show you can be incredibly effective, too.

From what I’ve seen — and what I’ll show you…

This could make a potentially HUGE improvement to your performance…across all your Fat Tail stocks and services.

I’ll show you plenty of examples of this in a second.

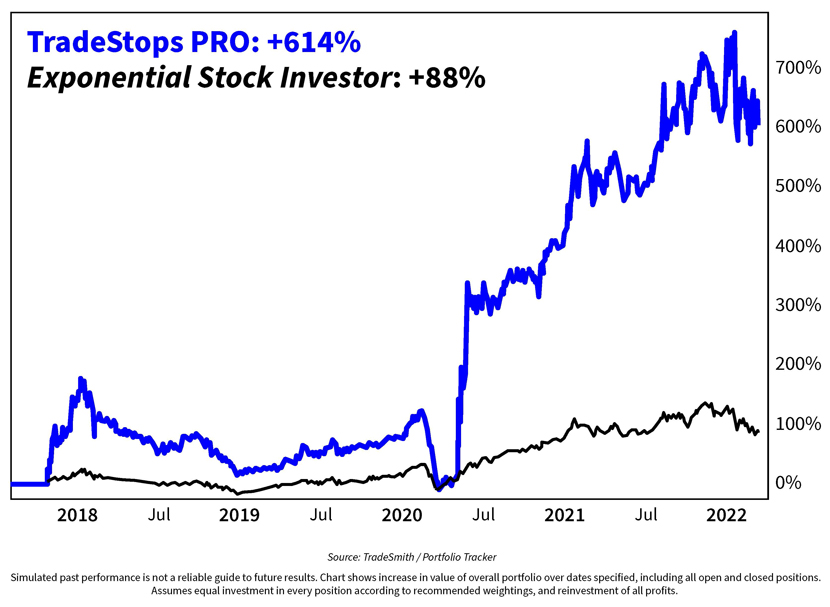

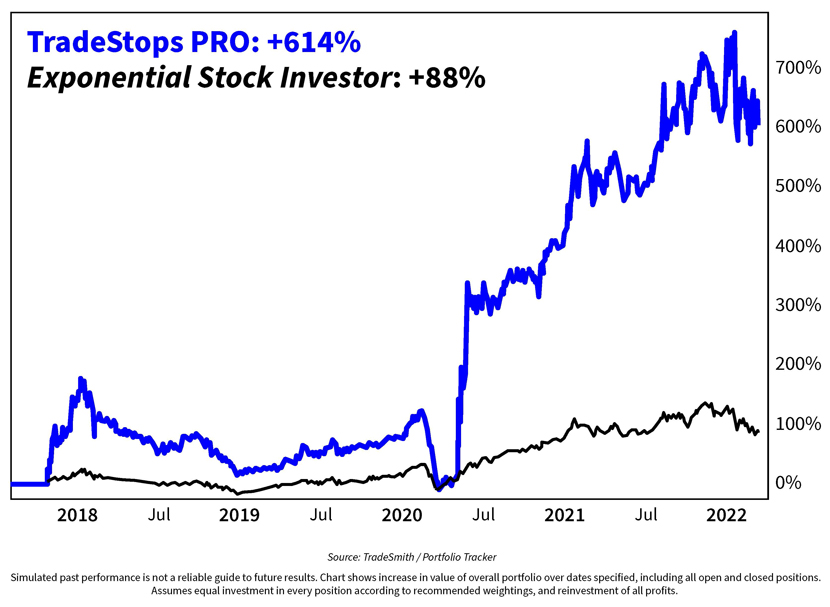

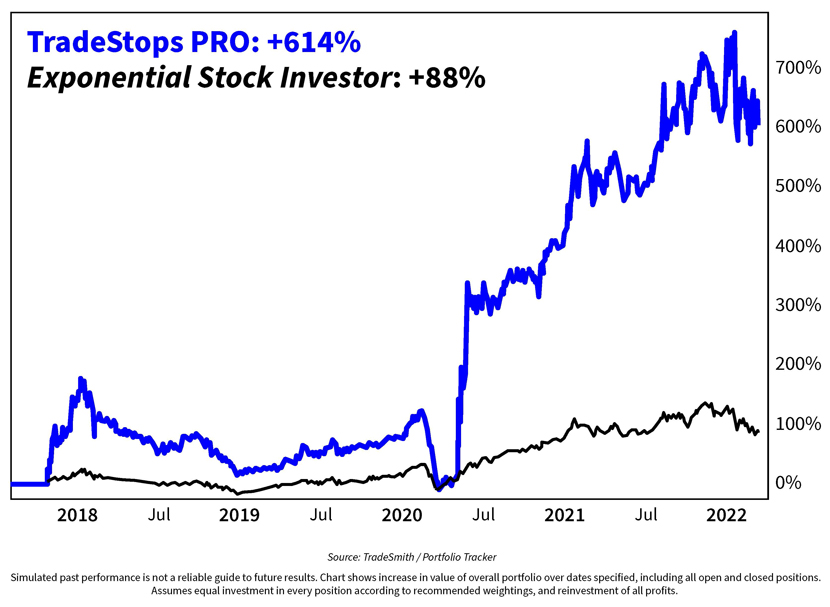

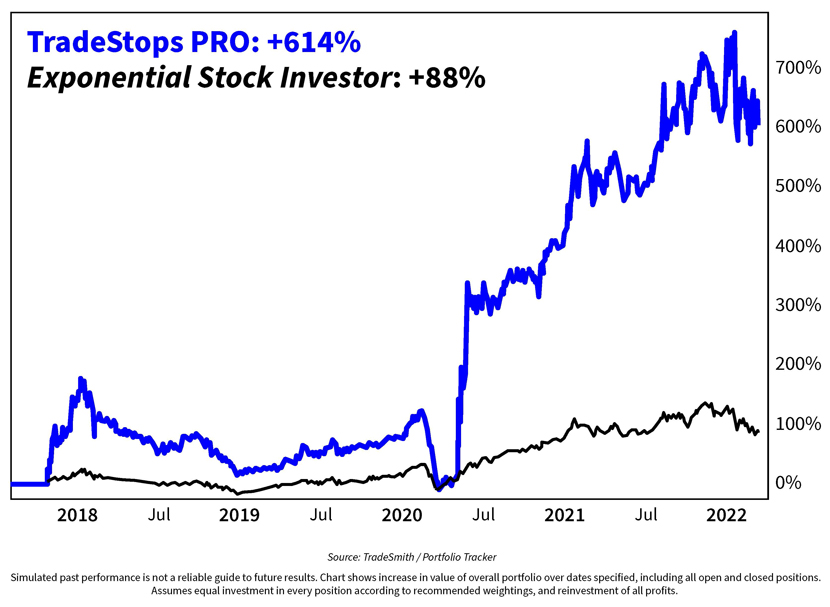

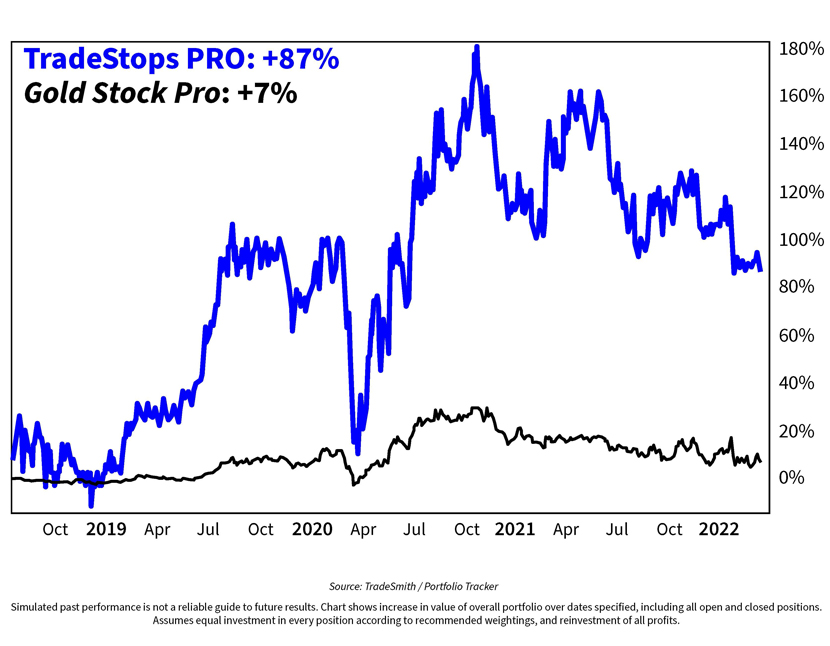

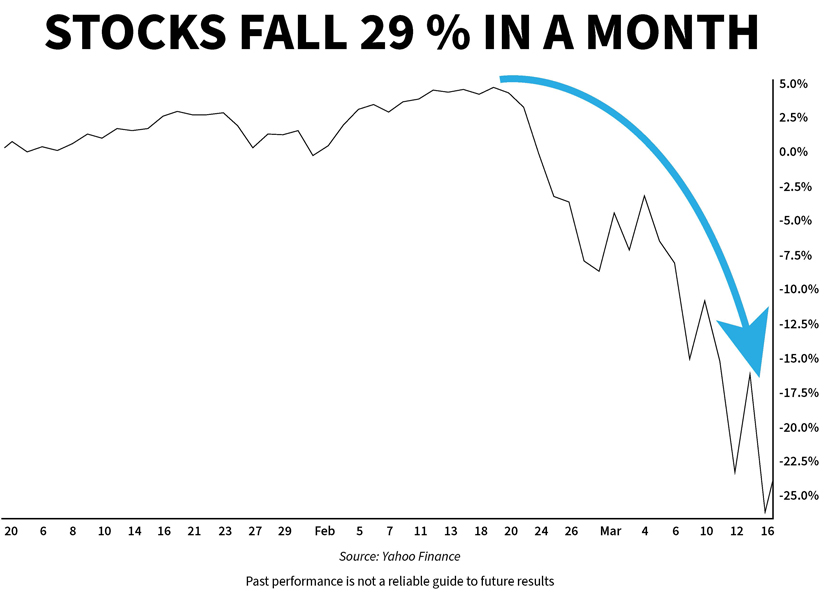

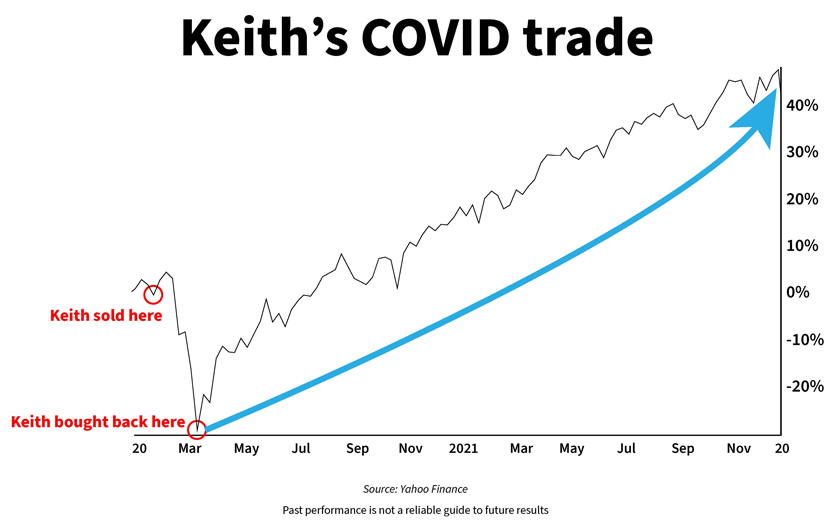

But just to whet your appetite, take a quick look at this:

In a nutshell: THIS is why we’re here today.

This is the ‘Invisible Edge’

we’re talking about…

This kind of thing could be achievable for you, across your Fat Tail stocks and services, starting right away.

And this is just ONE example of our backtesting…I have plenty more to show you.

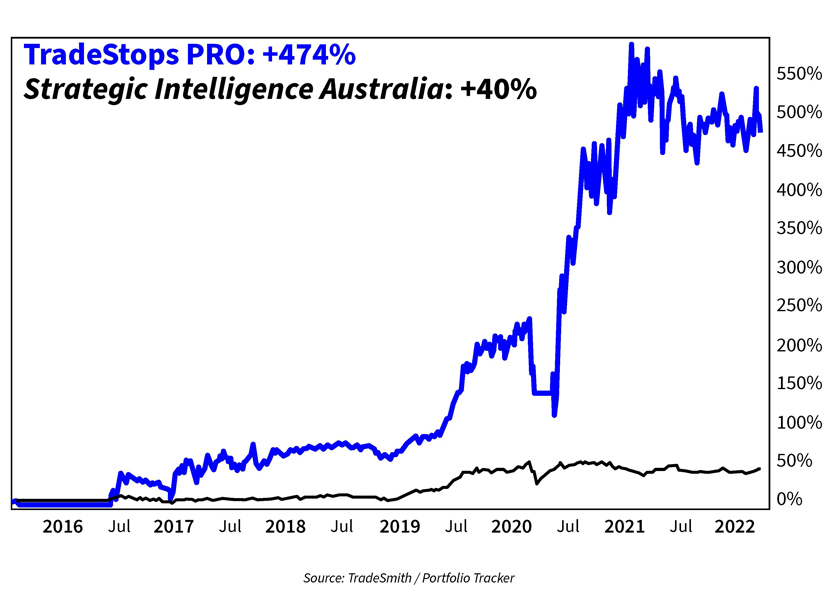

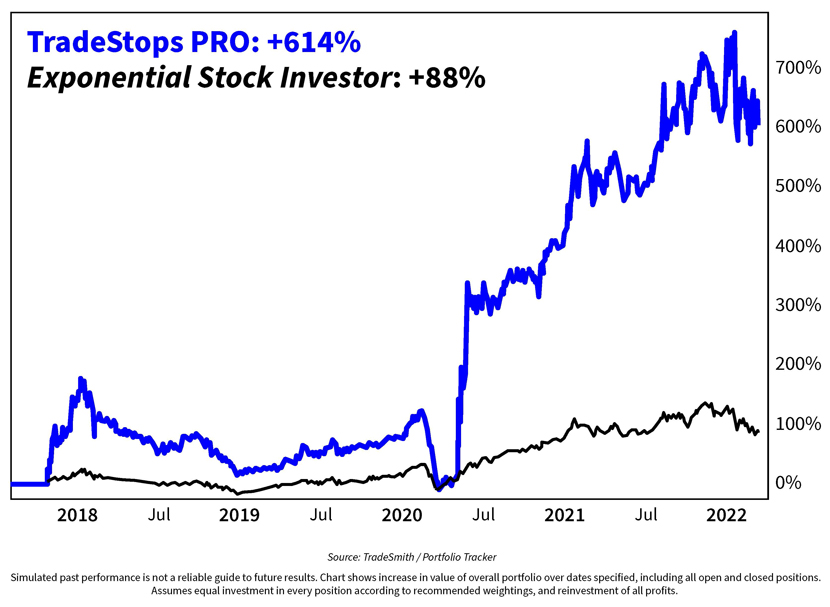

This one shows our popular small-cap service, Exponential Stock Investor.

You can see two lines here.

The black line at the bottom?

That’s the performance Ryan Dinse and the team have shown across all their stock picks — open and closed — since the service began in 2017.

It shows what the increase in the value of your holdings would be over that period.

In a word? FANTASTIC.

If you’d followed all the buy and sell alerts put out by Ryan over the last five years, the value of your holdings would have increased by 88%.

When you consider the market conditions we’ve endured over that time, that’s a GREAT result.

But I know you’re looking at the blue line…

And you SHOULD be…because this is what we’re here to talk about today.

This shows you the back-tested performance of a software overlay called TradeStops Pro.

And you can see…

Instead of increasing the value of your Exponential Stock Investor picks by 88% over that time…

You could theoretically have increased it by 614% instead!

That’s around SEVEN-TIMES more — from the exact same stocks.

Now, how would you get this kind of outperformance usually?

With leverage, right?

With some kind of high-risk trading strategy…

Well, this isn’t that

There’s NO leverage — none whatsoever — being used to get the result shown by the blue line here.

No CFDs. No options. No additional capital risk.

What you see here — a seven-times-outperformance — is the result of a simple software overlay.

This software can be YOUR invisible edge in the market.

It can help you decide when to buy…sell…

And when to buy back into a stock you want to hold long term…

With the aim of reducing your downside risk…

And only having you IN the stock while it’s going up.

It can suggest things like how much money to risk on any given stock in your portfolio…based on a calculation of the volatility in that stock.

It can also show how it’s possible to balance your risk equally across all the stocks you hold…

So that you’re not overinvested in any risky companies or sectors that could cause a disproportionate amount of damage to your trading account in the event of a crash.

Put all that together, and this result — this blue line — is what could have been possible, on YOUR Fat Tail stocks.

Now…can you imagine having that kind of an edge right now — at such an unpredictable time in the markets and the world?

Can you imagine achieving

a seven-times-better outcome…

Like the one shown by the blue line here…

WITHOUT options, CFDs, or ANY kind of leverage?

And the best bit?

It’s all done invisibly…in the background…at the click of a mouse.

Download the app.

Plug your portfolio in.

And let the software do its job.

You just get the alerts…and then act on them as you go — if and when you want to.

People all over the world — including right here in Australia — are using TradeStops systems to get an invisible edge in their investing.

David from Perth says:

‘This system has the very real potential of being able to supplement and eventually replace the income from my job…’

Now, I know this looks good — I haven’t been able to take my eyes off it either!

But let me just be clear: this is backtesting…or simulated past performance.

No one actually did what you’re seeing here, represented by the blue line on the screen.

We just took the performance of the Exponential Stock Investor portfolio — on open and closed trades — since its inception in mid-2017, and applied this software to it, after the fact.

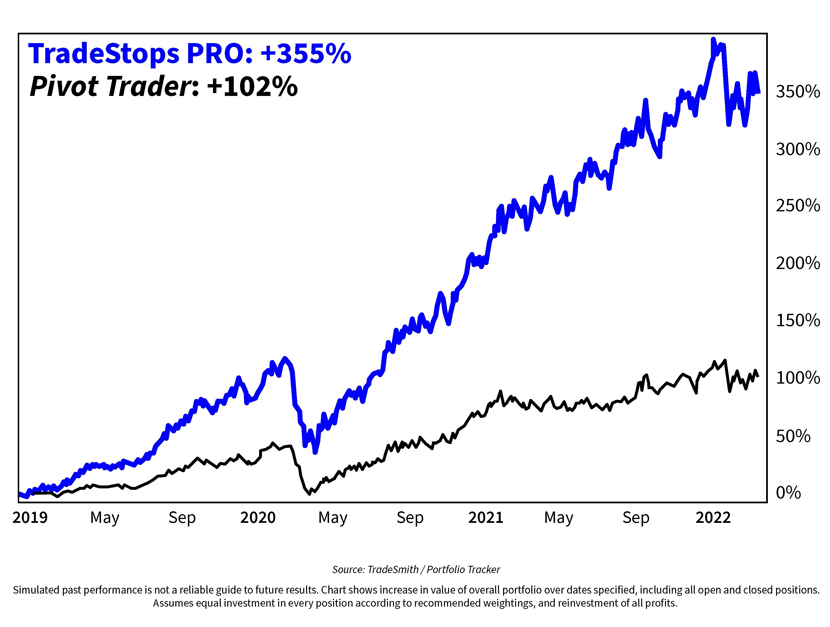

Now, what if I were to tell you that this tracking software beat every single one of the Fat Tail services we tested over the time periods specified?

Well, that’s EXACTLY what happened

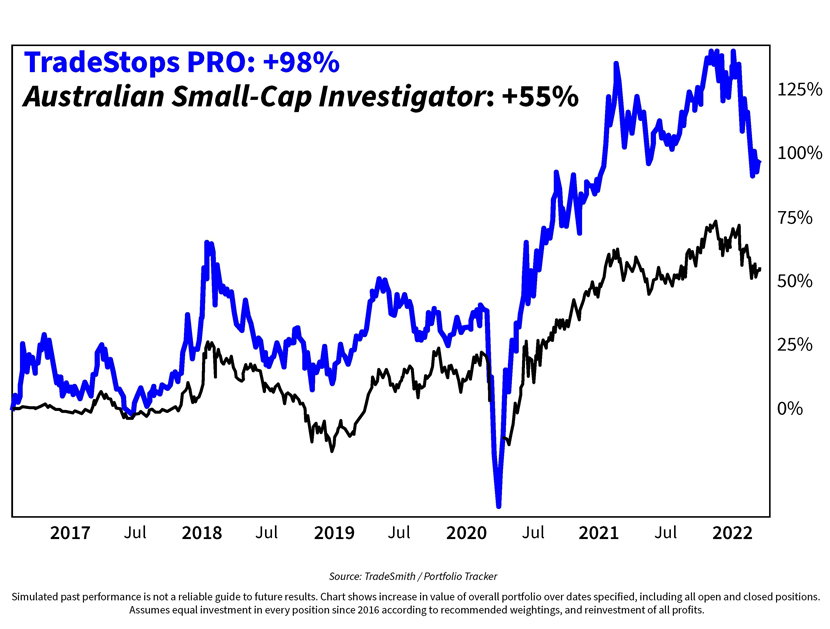

Some to a greater degree, others to a lesser extent, as you can see here…

Now, of course, we need to remember that past performance is not a reliable guide to future results.

As good as these charts look, we can’t guarantee a similar outperformance in future.

But I’ll show you more of these incredible test results as we go tonight.

Plus, I’ll show you the quick and easy way you can add TradeStops Pro to your own Fat Tail stocks today.

Also standing by — and I can’t wait to talk to him — is Keith Kaplan.

Now, if you’ve been a Fat Tail subscriber for a while, I’m sure you’ll have seen Keith before…

But it’s an absolute pleasure to have him back with us — he joins us tonight via Zoom from his office in Baltimore in the US.

Keith, how are you doing?

KEITH KAPLAN

I’m very well thanks, Woody — it’s great to be back…

And I’m looking forward to walking Fat Tail subscribers through our TradeStops Pro software today…

I think they’re going to love what we have to share with them…

This really could provide an ‘Invisible Edge’ to your subscribers, Woody…

And that could come in especially handy at this uncertain time in the markets.

Bottom line: as you’ve just shown, we want to give your subscribers the chance to do EVEN BETTER from the great stock research they get from your publishing business…

And do so in a simple, ‘invisible’ way. With no leverage, no new stocks, and no additional capital risk.

WOODY

Thanks, Keith. We’ll get to the nuts and bolts of how everything works in just a second…I know you’ve got several really compelling examples to show us.

Now, to give Keith his proper due, he is the CEO of TradeSmith — the company behind the ‘Invisible Edge’ we’re going to demonstrate for you today.

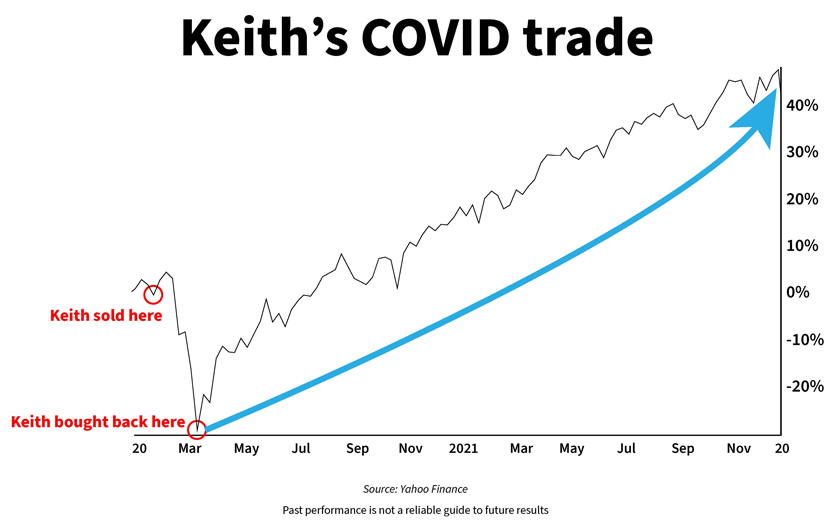

You’ll hear more from Keith in a moment…including how he used the TradeStops software to avoid a major loss in the coronavirus crash of March 2020…

And then buy BACK into his stocks, just as the market was turning up again.

He ended up turning what would have been a 24% LOSS in his portfolio into a massive opportunity…

Just by paying attention to the alerts his stock monitoring software triggered.

But before we talk to Keith, I want to give you an idea of some of the key benefits of the TradeStops Pro software…

I want to show you what it can do…and how it could help you make better-informed, and hopefully more successful, investment decisions when you buy and sell shares.

And let’s face it…

There’s a HUGE need for

this kind of help right now

The financial world is extremely fragile at the moment…

Markets are being buffeted by things like soaring inflation…

Rising interest rates…bond yields on a roller coaster ride…

War in Ukraine…supply chain crunch…cost-of-living crisis…

And the economic aftereffects of two years of COVID lockdowns.

In the US, the S&P has had its worst start to a year since 1939.

While here in Australia, the ASX 200 has been all over the place…and is down close to 5% at the time of recording.

You know, it’s hard enough to make good investment decisions when the markets are CALM!

But right now, with things as they are, it’s a MASSIVE challenge.

Thankfully, it’s one that our editors and experts here at Fat Tail have risen to…

Over the past two years particularly, they’ve consistently provided you with excellent ideas and advice on how to weather the turbulence…

…and potentially even PROSPER from some of the opportunities that have arisen as a consequence of these precarious times.

But what if you could do even better?

You see, here’s the problem…

We can only do so much here at Fat Tail Investment Research.

We can’t invest FOR you.

And as you know, we’re not permitted to give you individual, tailored financial advice.

Even if we were, with more than 30,000 unique subscribers on our books, it would be IMPOSSIBLE to create an individual plan for every one of you.

And yet, as I just said, NOW is the time where you REALLY NEED that kind of guidance…

I mean, just look at the Aussie stock market since the start of the year…

We’ve had some BIG sell-offs…followed by rallies that are just as big.

It makes for a really confusing picture.

When the market falls, you’ve no idea if this is going to be ‘the big one’…

And with each rally…you don’t know if it’s a ‘dead cat bounce’…or the next stage of a massive melt up.

So you’re looking at a chart like this one…

And you’re reading the news headlines…

And you’re thinking:

Should I sell everything?

Should I hang on in there?

Should I buy the dips?

And by the time you’ve made your mind up, the market’s moved on again!

We seem to be trapped in that cycle at the moment.

The problem is uncertainty leads to irrational thinking and poor decision-making.

And that, as Keith will show you in a second, can be fatal — whether you want to build wealth or just preserve it.

TradeStops Pro can help you

make those important decisions, confidently and quickly

Because it not only takes into account volatility in the market…

It considers your SPECIFIC capital position, risk tolerance, and financial goals.

And it may even help you — as we’re about to demonstrate — squeeze MORE MONEY out of your current positions…

With no additional capital risk.

And no more stocks, newsletters, or trading services.

That’s right, TradeStops Pro doesn’t REPLACE the good work our experts do here at Fat Tail…

It BUILDS on it…

With real-time stock tracking and monitoring…that’s more tailored to YOUR preferences…

All with the aim of helping you avoid downturns…ride bull markets…and maximise returns from the stocks you own.

First, by giving you the peace of mind to stay in stocks that are going higher…

And second, by alerting you to the potential of a crash…

Giving you the opportunity to sell your stocks before the market tanks.

And I’ll repeat:

You don’t need options, CFDs, or anything risky like that

You just download the TradeStops Pro software, upload your stock portfolio, and let it do its thing.

It’s a huge deal, isn’t it?

Especially given the market conditions right now.

But I’m confident this software can help you pull it off.

Keith, was that a reasonable description of what TradeStops Pro is designed to do?

KEITH

I couldn’t have said it better myself!

WOODY

Well, I think this is a good moment to bring you back in…

Because you actually DID use the TradeStops signals to avoid a huge crash — back in 2020 — didn’t you?

KEITH

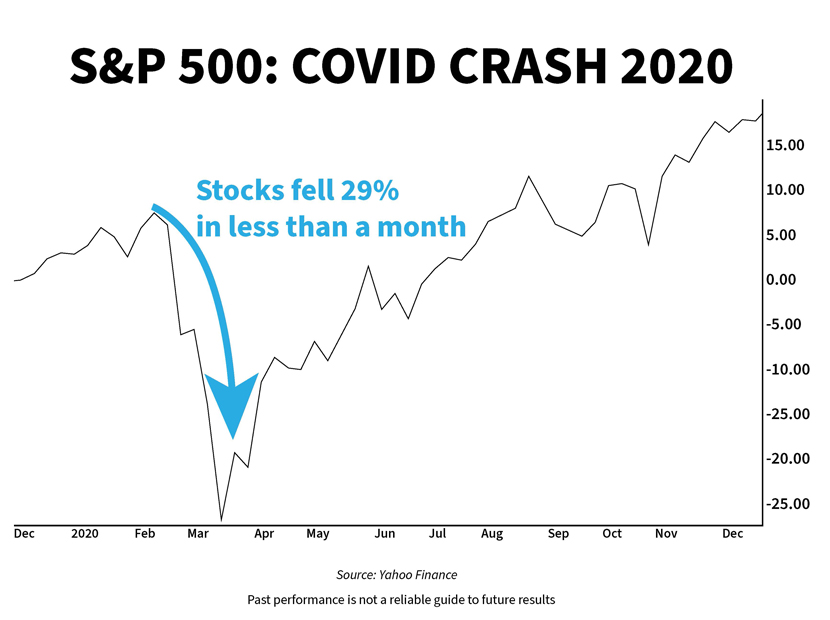

I did, Woody…it was during that horrible time in March 2020, when the market tanked because of the coronavirus pandemic…

WOODY

Why don’t you tell us the story?

KEITH

Sure, but before I do, I should point out to your subscribers that I’m NOT a financial expert.

I’m not an economist…or a stockbroker…or a hedge fund manager…or financial adviser…or anything like that.

I’m a software engineer.

But I invest too.

And I have the exact same hopes and fears and flaws and biases as everyone else.

We’re all emotional beings. And that side of our personality really comes to the fore when our money is on the line.

It forces us to react…instead of taking a beat and thinking things through.

And believe me, I’m not immune to this.

I’ve made the same mistakes most investors make…

I’ve bought popular stocks at the top of the market, only to watch them crash shortly afterwards…

And I’ve sold stocks too early, at the first sign of a correction…only to see them turn round and take off in the opposite direction!

The point is…

As humans, we’re hardwired to

react to situations emotionally first, and rationally second.

If we think there’s a chance of making quick money on a stock, we just see dollar signs…

And we pile in without weighing up the risks of committing all that cash.

Conversely, if we think we’re about to lose everything in a big crash, we snatch our money out of the market straight away…

Never stopping to consider that the downturn might be a short run thing.

WOODY

I guess we’re all a product of our biases, Keith…

…and because of that, our investing experience is littered with these missed opportunities!

KEITH

Right!

And that’s why TradeStops Pro exists.

To sit between you and the market…

And provide rational, mathematical signals at these critical inflection points…where everyone else is either panicking or getting carried away.

We believe that if you can avoid making those knee-jerk decisions…

And listen to what the data is telling you…

You can be much more successful overall in the market…

In fact, in ANY kind of market.

And you’re quite right, Woody, I have first-hand experience of using this more rational, software-driven approach to avoid a big crash…

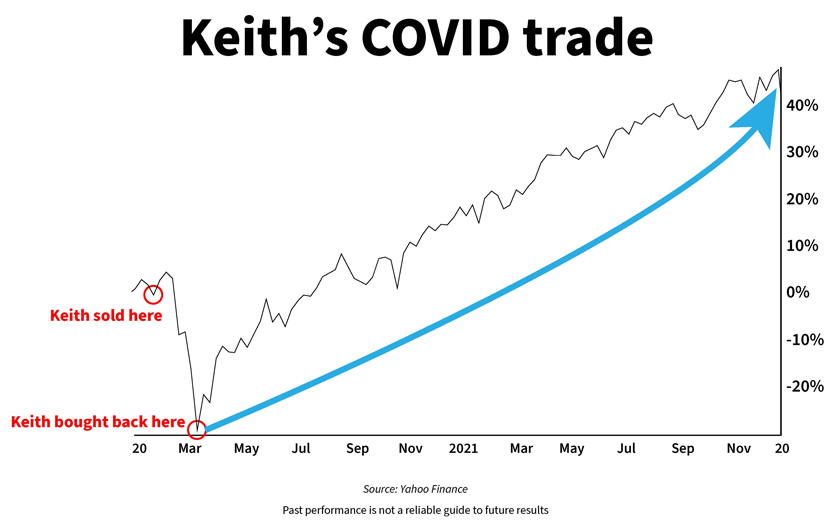

I was heavily invested in the stock market back in February 2020, when the market started tanking in response to the coronavirus pandemic.

Most of the folks watching will remember.

It was AWFUL…

The market fell over so quickly…investors panic sold because they weren’t expecting it.

BUT…

If they’d had access to the TradeStops software — like I did — they wouldn’t have needed to panic.

They could have been better prepared for what was to come.

You know, if it wasn’t for TradeStops, I’d have lost almost a THIRD of my invested capital back in February of 2020.

Now, this looks pretty shocking, I know, and believe me I felt it — because up to this point, I had a number of big positions in US stocks.

But thanks to TradeStops, I was mostly IN CASH just before the market really hit the skids here.

I sold my stocks for a relatively small loss and got out.

WOODY

You were in cash?

How did you know to sell?

KEITH

Well, I got an alert from TradeStops in February that several of my stocks had hit their ‘dynamic trailing stops’.

Now, I’ll explain that term in more detail in a moment, with a few examples.

But one of the really cool things TradeStops Pro can do is suggest stop loss levels for all of your stocks…

And these levels are DYNAMIC…

Meaning, they move up and down in real time, depending on the volatility in that individual stock at that particular time.

That’s a key point that I’ll come back to later…because, Woody…

This can make a HUGE

difference to your results!

See, most stop-losses you set with your broker tend to be fixed…rigid…based on an absolute dollar level.

Others are called ‘trailing stops’, which track the stock…but are based on a pre-determined percentage drop in the price.

They’re difficult to know exactly where to set because they don’t take current market conditions into account.

Ours are different.

They’re based on an algorithm that calculates the volatility in that stock in REAL TIME.

Now I know that sounds a bit complicated, and I won’t get into the science behind it here…

The crucial thing is it can help you get OUT of stocks in a timelier fashion…

And STAY IN stocks you like…and that are generally trending in the right direction.

I’ll show you how we’ve applied it to several Fat Tail stocks in a moment…

WOODY

OK cool. So back to February 2020…

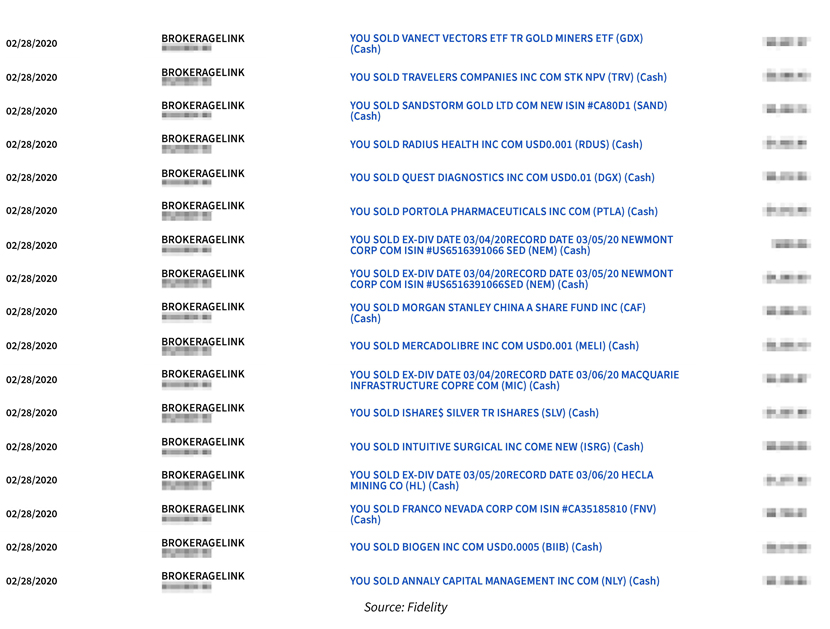

You got the bear market alerts from TradeStops…

KEITH

Yes…and straight away, I dumped many of my stocks.

Here, I think you can see a screenshot of my broker account, showing all the sell order confirmations in February…

Now, we’ve pixelated out all the monetary details here…

But I can tell you, Woody, I had a sizeable amount of cash in these stocks…

Believe me, I would NOT have wanted to kiss goodbye to almost a quarter of it!

But thanks to TradeStops, I didn’t have to!

I moved to a mostly cash position, took a much smaller loss of 7%, and rode out the storm.

Now, as your subscribers will know….

The next month was CARNAGE…

WOODY

I remember it well.

We took loads of calls from anxious subscribers asking us if this was ‘it’…

I mean the COVID crash took everyone by surprise!

I actually think our editors were nimbler than a lot of people in their response to it…but clearly not as nimble as you, Keith!

KEITH

I was so thankful for those alerts…but you know, that’s just TradeStops doing its job.

That software protected me from a HUGE loss in March 2020…not to mention all the panic and despair that goes along with it.

Now that was great, obviously…and I can’t even tell you how thankful I was.

But even better was to come…

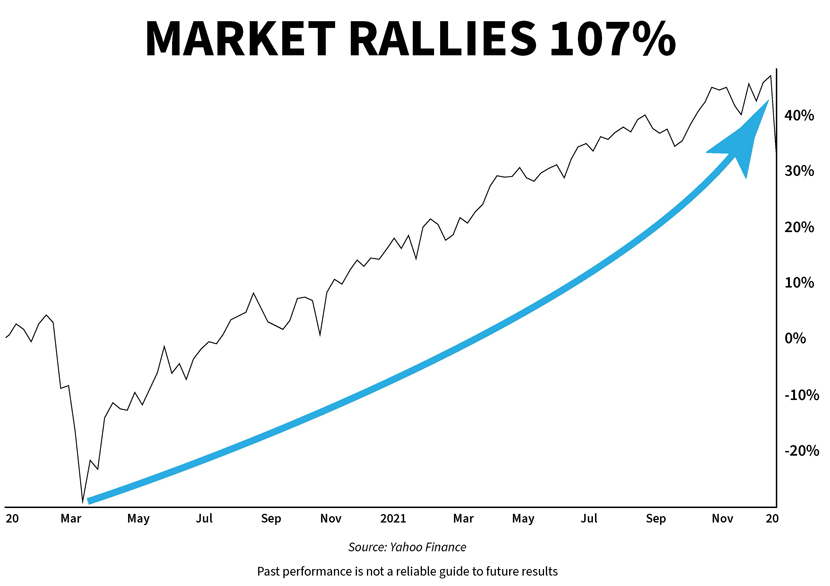

As you know, the market bounced back after the March 2020 crash — in fact, it rallied hard…

CNBC even said it was the ‘fastest bull market rally since World War 2!’.

You’ve got to remember Woody, many investors thought ‘this was it’, the big crash.

Very few people thought we’d see this kind of a rebound.

But TradeStops Pro doesn’t think.

Or react.

It calculates…

And in April it flagged that several stocks were gaining momentum again.

I received a number of alerts from something called the Health Status Indicator.

It’s another TradeStops Pro tool that I’ll talk more about in a moment.

But very quickly, the Health Status Indicator — or Health Tool — works like a kind of ‘traffic light’ system for your stocks.

If a stock is showing red in the health tool, you should consider selling it.

And if you don’t own it, this probably isn’t the time to buy it.

If the stock is showing yellow, exercise caution. It could go either way.

And if the stock turns green, that indicates momentum is with you, and it’s a good time to consider buying.

That’s basically it. I mean there’s a lot more that goes on behind the scenes…but I’ll get to that shortly.

Anyway, several stocks started turning green in April 2020.

So I used that intel to re-enter the market.

Sure enough, the market turned…

Giving me the chance to capture most of the rally that you can see here:

WOODY

This is great work Keith!

So let’s see…

You were able to stop a 7% loss turning into a much worse 24% loss when the market fell over…

You then sat mostly in cash while the market was crashing hard…

And then you bought back in…just in time to catch most of the big rally that we can see here.

In fact, from the low of 23 March 2020, to the end of 2021, stocks went up 107%.

And you had the chance to catch a big part of that surge…

KEITH

That pretty much describes it, Woody.

But as happy as I was with the result, I can’t really take the credit…for any of it.

This is all down to TradeStops

Like I say, I’m no market expert.

I’m not a professional trader.

I just don’t have that kind of confidence or knowledge.

But the TradeStops software more than makes up for my shortcomings.

It helps me get the most out of all of my stock investments…no matter what’s happening in the market.

And that’s how I think it can help your subscribers, too.

WOODY

OK, so we’re going to dig into the TradeStops Pro software with Keith next…

And show you how you can apply it to the stocks in YOUR portfolio.

But I want you to think for a moment about how much peace of mind something like this could give you…

Especially when the stock market is so precariously balanced — like right now.

Imagine being able to avoid any big future falls…

And having the confidence to get back into — or stay in — stocks that are going up.

And by the way, you can set TradeStops Pro up simply and quickly on any Australian stocks, and any Fat Tail model portfolio.

It works with all of our stock recommendations…

Again: not to REPLACE the great work our editors do…but BUILD on it.

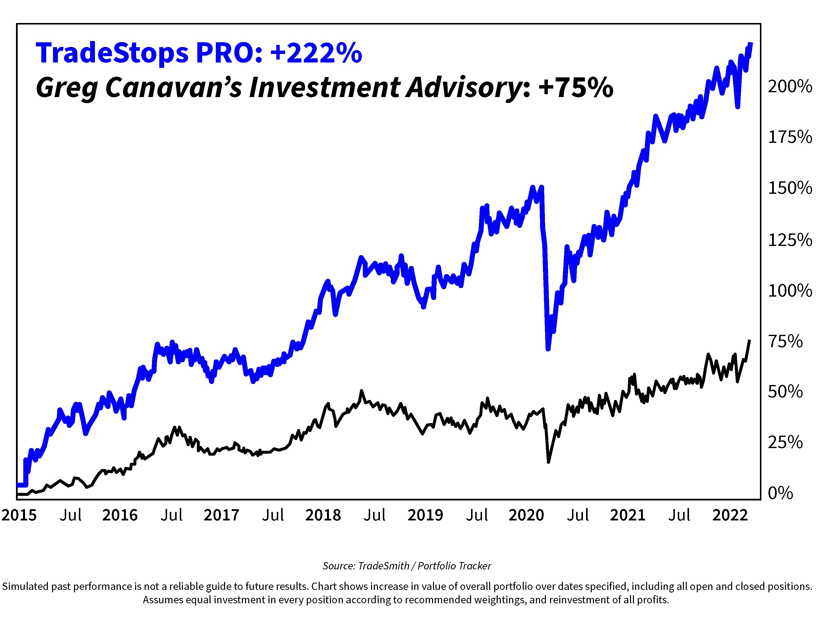

Let me show you what I mean with a couple of quick examples…

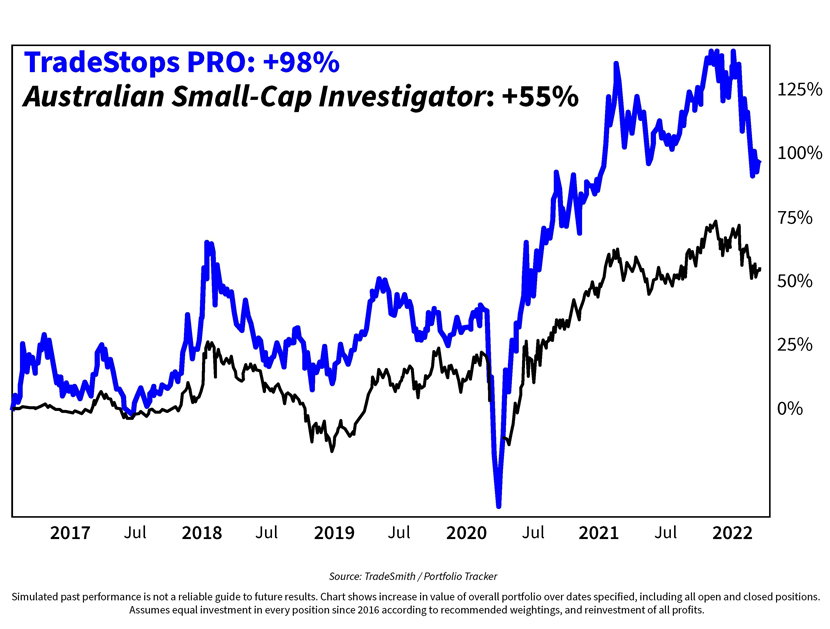

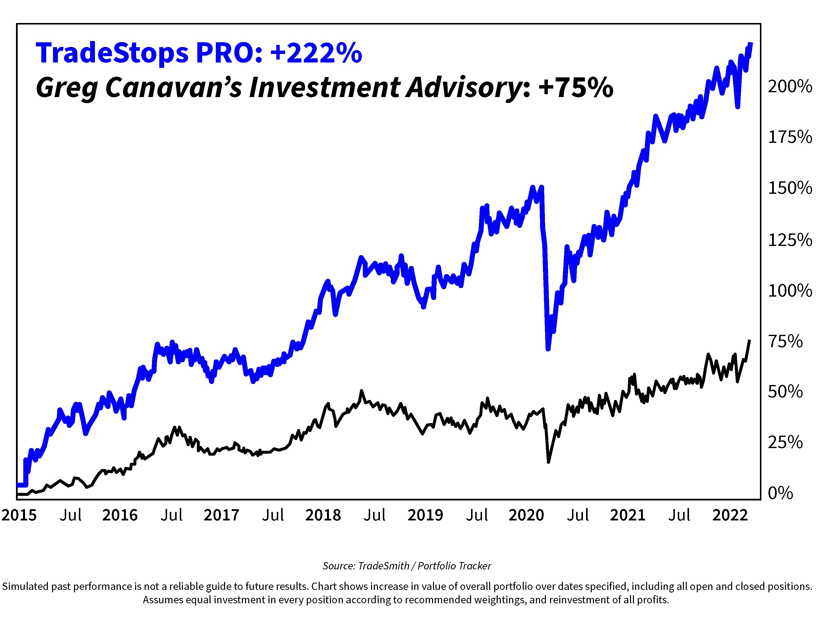

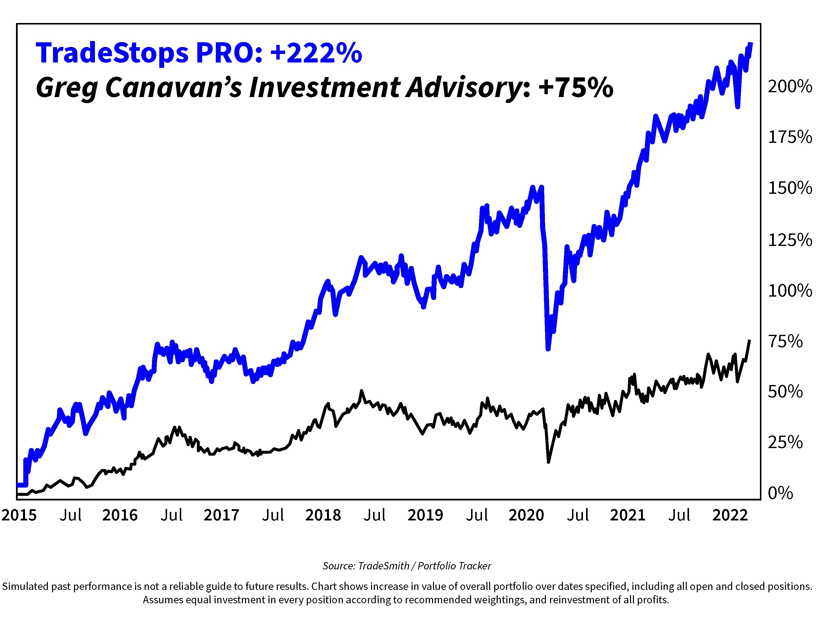

So there are two lines on this chart and I’ll quickly explain what they are…

The black line shows the performance of Greg Canavan’s Investment Advisory research service over about seven years between 2015 and 2022.

It’s based on all of Greg’s open and closed recommendations…

And shows what the increase in the value of your holdings could have been over this time…had you taken an equal position in each stock and reinvested all your profits.

As you can see, Greg has done a great job for his subscribers during a really challenging time in the market.

A 75% increase for a service that isn’t focused on explosive growth is excellent — so let’s credit Greg for that.

Now. Look at the blue line.

That’s what happened when we applied the TradeStops Pro software in back testing.

So, be clear — we didn’t ACTUALLY make any of the trades suggested by TradeStops here.

This is what’s called ‘simulated past performance’ — and it’s no guarantee of what could happen in the future.

This just shows what COULD have happened, had we followed each one of the TradeStops signals generated during the test.

And had we done that, we could have come away with a 222% increase from Greg’s stock recommendations, which is about THREE times better.

And again, with no leverage, CFDs, or options. Same stocks — different result.

Does TradeStops ALWAYS get it right?

Most likely not. Sometimes the signals may be off, or even wrong.

But then, TradeStops Pro isn’t a stock picker or trading guru. It’s a piece of software.

Your success will always be dependent on how quickly you’re able to act on the signals TradeStops Pro generates if you choose to.

So actual results will vary.

But still — like I say — this is very nearly THREE times better…

From the SAME stocks…with

NO additional capital outlay

Are YOU one of Greg’s subscribers?

Well, if you are, take a good look at this…and have a serious think.

Compelling, isn’t it?

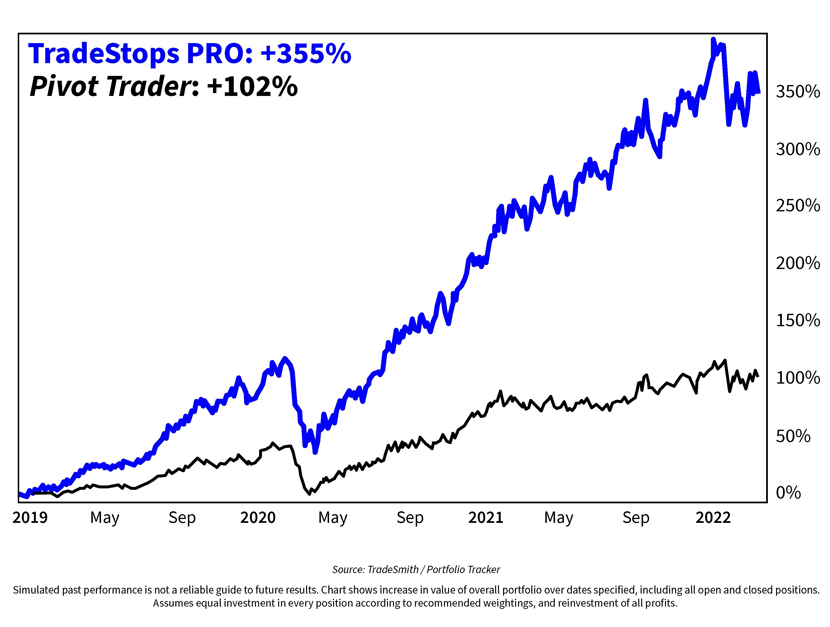

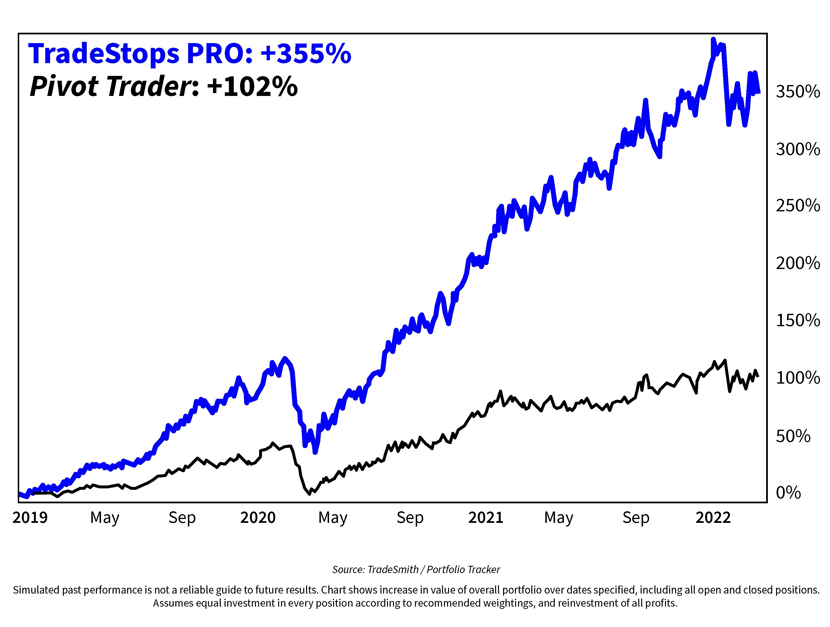

Here’s another:

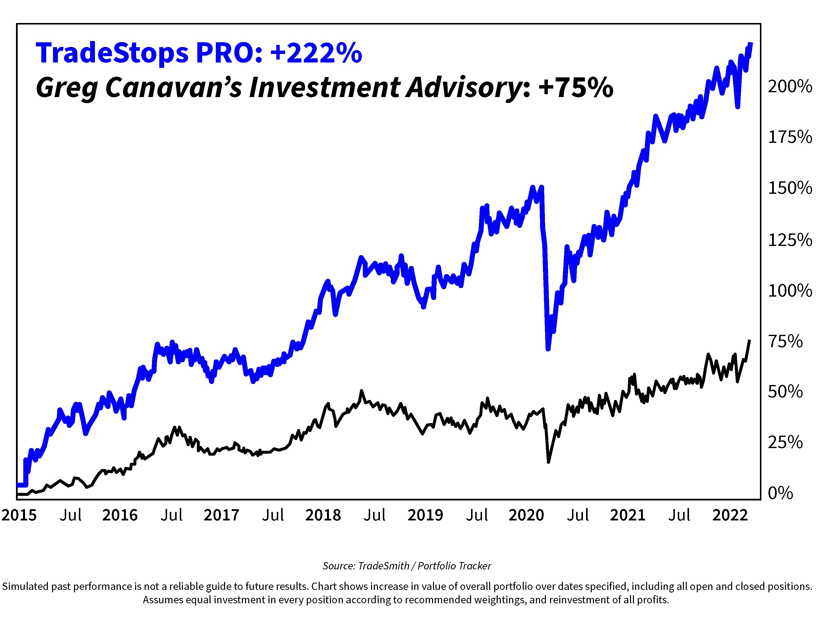

This is our popular Pivot Trader service, led by Murray Dawes.

Again, the black line shows the increase in value of all of Murray’s open and closed trades between the beginning of 2019 and roughly the time of recording.

102% is a standout result.

Showing subscribers how to double their money in one of the most volatile markets in living memory is no mean feat, let me tell you.

But now look at the blue line — like you weren’t already…

This is the result of backtesting the TradeStops Pro software against Pivot Trader…over the exact same period, using the same stocks and the same entry points.

And it shows that, had you acted on the TradeStops Pro alerts, your holdings could have increased by 355% instead.

Again, I must stress, this is hypothetical — the result of backtesting — and can’t be relied upon to predict future results.

But it amounts to a three-and-a-half times better result over the SAME time frame…

…again, achieved with NO new stocks, leverage or extra risk.

And if you’re worried that you won’t be able to get your head around this, don’t be.

You don’t need to be a computer programmer to decipher the software or any of the alerts…

You don’t even need to be all that ‘tech savvy’.

The alerts come via a simple phone app.

You can also have them delivered to you by email too.

And there are video tutorials…walk throughs…customer services teams…

Even a 1-on-1 concierge laid on by the TradeStops team to help you get the software set up.

Look, I’ve seen this in action and believe me, you shouldn’t have any problem getting started.

We’ve worked with Keith’s team for nearly three years now — and we’ve made sure they know exactly what you want.

You can view all your Fat Tail portfolios — and all your stocks — in the app…

Select any new ones by entering their ticker symbols…and set up how you’d like to receive your alerts.

There’s just so much you can do with TradeStops Pro to take your investing to the next level…

It can help you tackle a lot of the problems that we at Fat Tail Investment Research are unable to solve for you

In fact, Keith, let’s drill down into a few of those specific problems right now — to show people exactly how TradeStops Pro can help…

KEITH

OK, so one of the biggest problems most regular investors have is knowing when to SELL their stocks.

Sell too late and you can lose money.

Sell too soon, and you can miss out on bigger gains.

Well, TradeStops Pro has a tool that can help you overcome this problem.

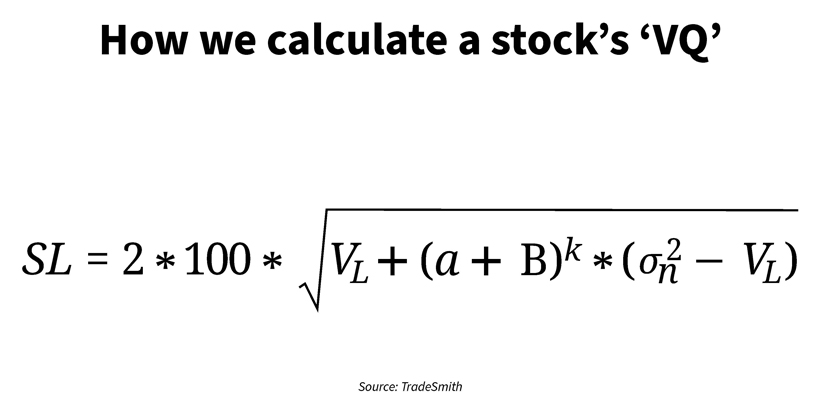

It’s called the Volatility Quotient — or ‘VQ’ for short.

Now don’t get too fixated on the terminology there.

The VQ is just a way you can set those dynamic stop-loss levels on all your stocks — with a simple click or tap.

And once you set these levels, they monitor each individual stock’s volatility in real time.

Now, most people watching will know what a ‘stop-loss’ is. And what its job is.

They are there to prevent a small loss from turning into a big one, essentially.

But the main problem with setting a regular ‘fixed’ or ‘trailing’ stop-loss is that the moment your stock encounters ANY volatility, you can be taken out of your position.

Tight stop-losses — a couple percent below the share price — can get triggered with even the slightest volatility in price action.

And you don’t want to set your stop-loss too wide…because that defeats the purpose of having a stop-loss in the first place!

So…we wanted to come up with a way to avoid this issue and make it easier for investors to know where to set their stops, based on individual stock data.

This way, investors could theoretically stay in stocks they liked for longer…

And even ADD to their positions that are going up.

Not only that — they could be prevented from being taken out of a position because their stop-loss got triggered in volatile conditions…

AND they could be prevented from losing a lot of money in a crash, because they set their stop-loss too wide…

BUT by the same token, we want investors to be able to sell stocks that drop quickly, where volatility is UNexpected.

These are all huge considerations

for investors…

And quite often people have to make quick decisions, in the heat of the moment, which pretty much amount to guesswork.

That’s where the VQ comes in.

Now the design of the VQ is simple:

To help you sell ANY stock at the best possible time.

Let me repeat that…

To sell ANY stock at the best possible time.

It does this by acknowledging that no two stocks are the same.

Some stocks are way more volatile than others.

And Woody, this is INCREDIBLY important at the moment when the markets are up one week and down the next.

The VQ can tell you how much volatility is ‘expected’ in any given stock — and how much is ‘unexpected’.

And that is super-vital intel to investors.

When you understand a stock’s volatility, you know how much up and down movement is ‘normal’.

If a stock is trading within a ‘normal’ range, you know that you don’t need to panic and sell.

WOODY

Wow! That WOULD be handy to know right now!

I mean, we all know that stocks are highly volatile at the moment…

…but you’re saying that it’s possible to know how much movement you can expect in any stock under normal trading circumstances?

KEITH

Exactly.

Think about a stock like Tesla versus Apple.

With Tesla, you’re typically going to see a high VQ score, because it’s super-sensitive to market sentiment.

Whereas Apple would have a lower VQ score relative to Tesla, because it tends to be a lot less sensitive, and therefore a lot less volatile.

The VQ score is simply a measure of ‘normal’ or ‘expected’ trading volatility.

And the equation we use to calculate it is on the screen right now.

TradeStops Pro can tell you the VQ score of every stock in your portfolio…

And this equation is running thousands of times a day, working hard to help you maximise your results

Like I say, it’s designed to show you when to consider exiting any stock.

Not too soon, so that you miss out on the potential for bigger gains…

But not too late, so that you run the risk of incurring heavier losses.

WOODY

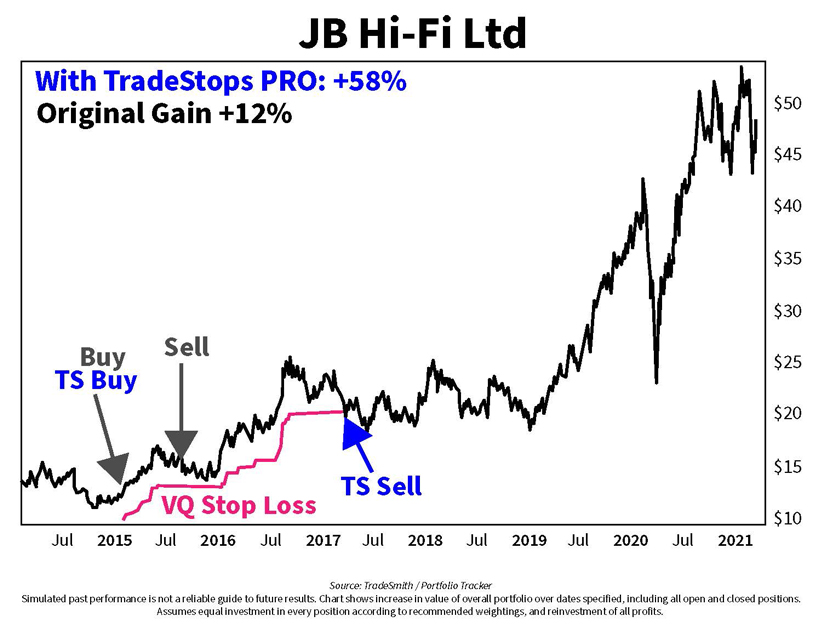

Now, we wanted to see what would happen if we applied the VQ to some of our Fat Tail stocks retrospectively.

So check this out…

This is JB Hi-Fi, a stock Greg picked for his Investment Advisory back in 2015…

So the black line is the stock price…

You can see the entry point back in early 2015.

You can also see where Greg sold the stock in August of the same year for a 12% gain.

But then there’s a blue arrow marked ‘TS Sell’…

…Keith, what’s going on here?

KEITH

So that ‘TS Sell’ arrow on the chart shows where the VQ dynamic stop loss would have been breached.

The VQ here is shown by the red line.

That’s the dynamic stop-loss level.

As I said, it’s constantly moving, never fixed.

And remember, we run about a thousand calculations a day on every stock to get these levels as precise as we can.

Now, just to remind the folks watching, this is simulated past performance — NOT an actual trade. You shouldn’t use this as a guarantee of future results.

We simply applied the VQ algorithm to the stock price retroactively.

But what it shows is that, had you entered this trade in JB HiFi when Greg recommended…and set a stop-loss with the VQ as your guide…

You could have stayed in the trade for a lot longer — and got out with a 58% gain…instead of the 12% subscribers actually made.

That’s almost a FIVE TIMES

better result

Now that’s no disrespect to Greg, who we all know is a first-rate analyst and a hugely experienced stock picker.

I’m sure he had his reasons for recommending selling the stock when he did.

In fact, you can see there’s a ton of volatile price action around the time he told his subscribers to get out — so maybe that had a bearing on things.

But what the VQ would have told you is that this volatility was considered ‘NORMAL’ in the context of historical price action.

WOODY

In other words: hang on…don’t panic…and ride out the storm.

KEITH

That’s how I’d interpret it…

And obviously, HAD we hung on, we could have ended up with an almost five times better result — hypothetically speaking!

WOODY

That’s excellent!

Let’s see another one…

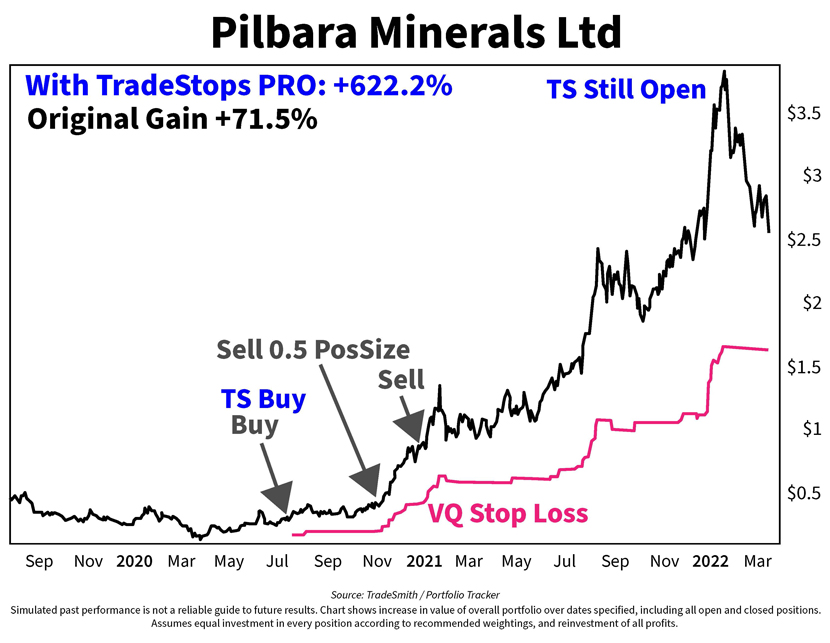

So this is Pilbara Minerals, which was one of Ryan Dinse’s trades in Small-Cap Momentum Alert.

Again, the black line is the stock price.

You can see Ryan’s entry point in around August of 2020…

He then instructed his subscribers to sell half their position at the start of November that year…

Then he sold the remainder of the position in December. So that’s a 71% gain in around five months.

Now that’s not to be scoffed at. But Keith, the VQ could have given subscribers a dramatically different outcome, it would appear…

KEITH

Yes indeed…

And again, to be clear, this is backtesting…just the result of adding the VQ to historical price action.

But this just shows you what the VQ can do.

And, in fact, with this trade, if you were paying attention to the VQ, you would still be in it at the time the test concluded…

…and instead of making a 71.5% return on this stock…you could be sitting on an open gain of 622.2%.

Woody, that’s nearly

NINE times better

With NO leverage, NO options, NO CFDs, or anything like that!

So say you invested $2,000 into this trade…

Ryan could have shown you how to turn that into $3,430 before costs — which is a great return…

But if you’d used the VQ, the backtesting shows you could have turned that same $2,000 into $14,444 — again, before costs.

WOODY

Wow — that’s incredible!

KEITH

Again, it’s just the power of the VQ.

Remember, it’s designed to keep you in stocks you like for longer…and sell at the best possible time.

I’m not saying it’s right every time.

And remember, a trailing stop doesn’t insulate you from a falling stock price.

You can still lose money when you set a stop loss guided by the VQ.

But if you set it properly, it’s designed to LIMIT any loss and give rising stocks — like Pilbara Minerals — the chance to really fly.

WOODY

And again, that’s no disrespect to Ryan who is one of our very best analysts and traders.

This is just a level of individual stock monitoring and tracking that Ryan is unable to give.

KEITH

Right.

And let me just say, to get the most out of the VQ — and all the other tools in TradeStops Pro — you need to have good stocks to work with in the first place…

And that’s where your guys come in, Woody.

They have the hard part. Our part is much easier!

WOODY

And in fact, YOUR part

is the easiest of all

You can quickly synchronise your entire stock portfolio with TradeStops Pro.

It will give you the VQ score on every stock you own.

Then you can set up automatic alerts so you can decide when to sell.

It’s a piece of cake to import your portfolio and set up alerts — I’ll explain how you can get started in just a moment.

But first, I want to talk about another tool in TradeStops Pro — called the Health Status Indicator…

And Keith this is the ‘traffic light’ tool you told us about earlier, right?

KEITH

Right. Now remember, Woody, we’re trying to solve some of the biggest problems your customers have…

And one of those is knowing when to buy back IN to a stock you like for the long term — if, for example, you just had to sell it for some reason.

So picture this…

One of your editors recommends a stock, and writes a detailed, eight-page research briefing explaining why this company is such a great buy…

They may have pioneered or patented some technology that’s going to revolutionise an industry…or solve some big problem.

When your editor picks this stock, they are most likely thinking in terms of a 3–5-year investment horizon…

But then two months later — BANG — the market dips…the stock falls sharply in trading…and crashes through its stop-loss, triggering the sell alert.

So all that great research…all that excitement…all of those hopes…

It all comes to nothing, ultimately, because — if you acted on the alert — you no longer own the stock.

WOODY

You know what, Keith — that happens more often than you’d think…

And it’s rarely because anything has changed FUNDAMENTALLY with the company or its long-term prospects.

It’s often down to market volatility…

Or a bad trading day…

Or the company announces a set of results that don’t live up to what the market was expecting…

KEITH

Right! None of this means this is now a terrible company.

It’s often just a speedbump — a temporary blip on this company’s upward journey.

But if you own the stock…and you like the company…it can be super frustrating to be taken out of your position.

WOODY

Absolutely.

And quite often for some of our guys, these recommendations are a ‘one-and-done’.

In the main, our editors rarely go back to these stocks after they’ve hit their stops…

Even if they were super-bullish when they made the initial recommendation.

They will have already moved on by then.

So how can the health tool help?

KEITH

Well, the Health Status Indicator is there to help you know when to buy back into a stock you like for the long term…

Just like it helped me get back into my stocks in April 2020.

It can also prompt you to stay OUT of a stock, even if it appears to be in good health…

Or exercise caution — so basically, hold your position and leave things for now.

And just like the VQ, the Health tool is included with TradeStops Pro.

It’s easy to apply it to

all the stocks in your portfolio

When you do, it assigns each of them a color: red, yellow, and green — just like a traffic light.

So as you just said, Woody, for many of your editors, the stocks they recommend are a ‘one-and-done’.

In other words, despite the editor’s conviction in the company…despite the quality of their research…

If they set a stop-loss and it gets breached…

…or if they issue a sell alert because of a sell-off in the market…

They rarely revisit that stock a second time even if the fundamentals pick up again.

WOODY

That’s right. They tend to move on.

The market is changing all the time…and new opportunities are always coming up. New challenges, too!

The moment a stock pick is out, our experts are already knee-deep in research for their NEXT recommendation…and that tends to be the focus for them.

KEITH

And, of course, that’s their job!

But as I said earlier: a good company doesn’t become a bad one overnight.

Oftentimes, these stocks recover from a short-term pullback, and power up again — to even greater heights…

And that means everyone who liked the stock based on the initial research, misses out on the rebound.

THAT’S why the Health Status Indicator is such a vital TradeStops Pro tool.

So…what it does is give you a real time health-check of every stock you upload.

And it assigns a ‘traffic light’ colour to each one.

- RED means you should probably consider selling the stock…and if you don’t own it, this probably isn’t the time to buy in.

- YELLOW means exercise caution. The stock could go either way.

- And GREEN indicates momentum is with you, and it’s a good time to consider buying — or getting back in.

Now…remember my story from February 2020?

Well, many US stocks that had fallen in the COVID market crash — turned green in the Health Tool in April.

That gave me the confidence to buy back into the market.

And Woody, I figured that I was buying good companies that had been smashed unfairly as the market sold off…

So I was more than happy to buy them at a much cheaper price.

And, as you can see, the health tool was right, and everything worked out pretty well!

WOODY

Well, it looks like you couldn’t

have picked it much better!

And you put this down to the Health Status Indicator?

KEITH

One hundred percent.

There’s no way I’d have had the confidence to buy those stocks at a time where the market had just fallen 29%.

But I know how good this software is, and I trusted it.

WOODY

And I bet you’re glad you did!

But I want to show you at home how the health tool might influence YOUR thinking…

Especially if you get taken out of a Fat Tail stock you like, because it gets stopped out after a correction or market sell-off.

So check this out…

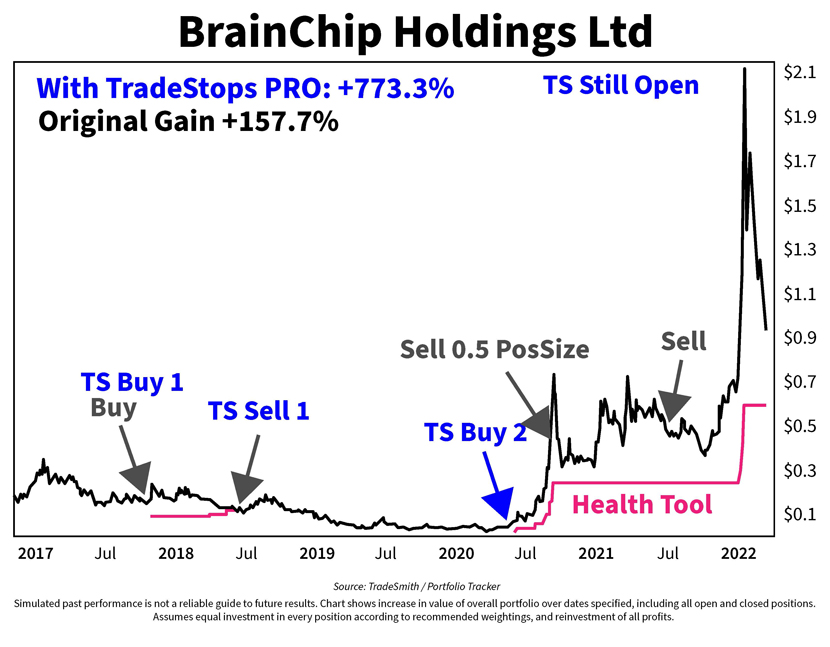

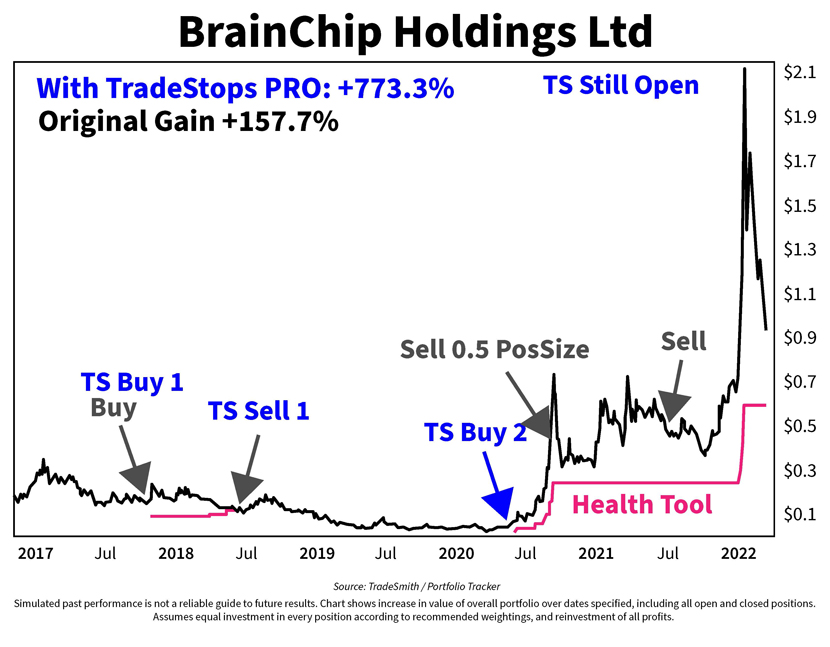

So this is a chart of BrainChip Holdings, a stock that was in the Exponential Stock Investor model portfolio up until about a year ago.

So you can see where Ryan Dinse’s recommendation would have got you into this stock — around September 2017.

But then around nine months later, in June 2018, TradeStops is showing a ‘sell’ signal on this trade.

Keith, what’s happening here?

KEITH

So that would indicate that the health tool is changing from green to red.

You can see the red line on the chart…

As long as the stock price stays above that, the trade is ‘green’ — in other words, that’s a healthy trade.

The minute the price hits the red line, the health status changes from green to red.

At this point, TradeStops Pro is telling you that this is no longer a healthy trade, and you could choose to sell the stock, if you wanted to.

WOODY

And again, nothing against Ryan.

He would have had a different set of criteria for exiting the trade…

But you can see that the stock price actually FALLS after the TradeStops Pro red signal.

So the software is doing its job there…

KEITH

Exactly.

And if we follow the price action, we can see that the health status for this stock turns green again in May 2020.

So, if you were still bullish on the company, you could buy back in at this point.

After that the stock goes up again…

…and in fact, you can see that Ryan instructs his subscribers to take half profit a few months later.

He then issues a sell alert on the rest of the position in July 2021 — leading his members to a 157.7% gain…which is excellent.

WOODY

Absolutely!

Full credit to Ryan…I think we’d all be happy with that!

That’s nearly FIVE times bigger

KEITH

Exactly.

And again, I’m not here to second guess any of your experts. There are any number of reasons to issue a sell alert…

And I need to remind everyone that this is backtesting — which means it’s a simulated result.

There are no guarantees you’d get a similar outcome in the future.

Still…even hypothetically speaking, on a $1,000 investment…

You could have turned it into $2,577 before costs with Exponential Stock Investor…

…or $8,733 before costs using TradeStops Pro.

WOODY

That’s a pretty persuasive argument for the health tool Keith…

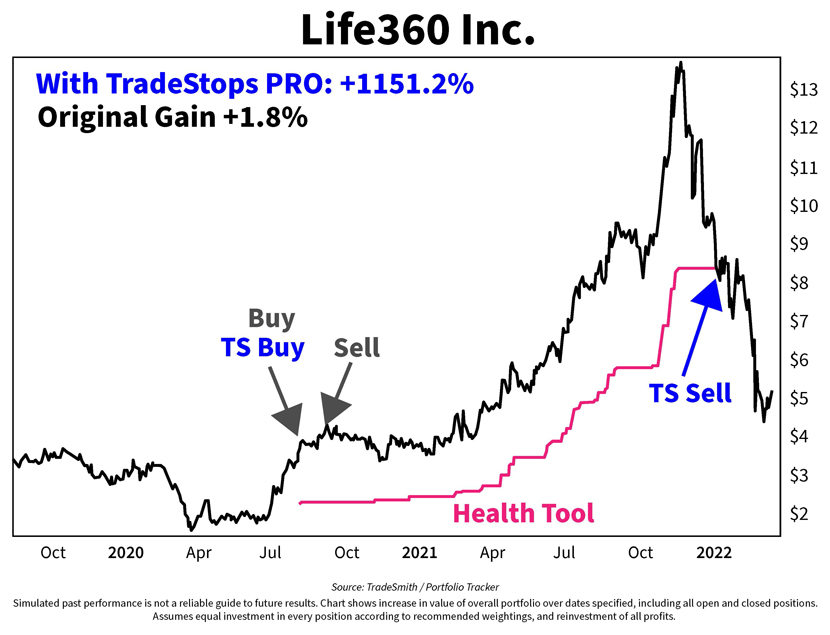

But if anything, this one might be EVEN MORE persuasive…

OK…let’s just unpack what’s going on here…

So this is ‘Life 360’ — which was a Catalyst Trader pick from 2020.

And you can see here, editor Callum Newman issues the buy alert around August time.

The stock goes up a little…and then Callum exits the position after about a month for a 1.8% gain.

Now that’s not a bad call as it turns out…because the stock actually dips after that.

So Cal’s obviously looking to make a quick gain in this trade…

…and something’s not quite panned out the way he wanted it to…so he’s jumped back out.

But a 1.8% gain is better than a loss, I suppose…

KEITH

Absolutely.

Now again, this is not to do Callum a disservice.

He’s an EXCELLENT trader, and I know he’s had some incredible results for his subscribers…

BUT…

When we applied the Health Tool to this trade in back testing, we got a completely different result.

In fact, as you can see here, this stock would have stayed green all the way up to January of 2022.

And had you sold it at that point…when TradeStops Pro told you the stock was now red…

Backtesting indicates you could have made an incredible gain of 1,151%.

Now again, I know this is a simulated result.

But it’s the difference between

making $18 before costs on a $1,000 investment…and making $11,510

That is the sheer power of the health tool, Woody.

WOODY

Absolutely. And again, no disrespect to Cal, but I know what I’d rather have.

In fact, I’m sure he would too!

So…

I hope you’re starting to see what kind of a difference TradeStops Pro could make to your investing life…

How it could help you make big investing decisions with more confidence…

Especially at such an uncertain time…where price signals are so difficult to decipher…because there’s so much going on in the world.

Honestly, there’s never been a more challenging time to try to predict the market and make good decisions with your money.

In this kind of environment, you’d want all the help you could get your hands on…

ANYTHING to help you manage your risk exposure and still shoot for great results.

Well, with TradeStops Pro you get the VQ AND the health tool on ALL your stocks.

You can upload your portfolio right away and immediately TradeStops Pro will help you determine: what’s the best time to sell?…and when do I buy back in?

What do you think?

Just these two tools ALONE could have a huge impact on your trading account over the coming months.

It’s a level above even what WE can offer you…

Seriously, to get this kind of individual stock monitoring…you’d either need to hire a professional trader to manage your money full time…

Or you’d need to get a Bloomberg Terminal subscription…which costs twenty-four grand a year, US…

AND it can’t even do what TradeStops Pro can do.

So look, keep this in mind.

At the bottom of this page, you’ll see a button.

If you scroll down and click it, you’ll go to a separate page where you can order a 12-month subscription to TradeStops Pro at a HUGE discount.

Even the FULL price of TradeStops Pro is a tiny fraction of the cost of the Bloomberg subscription…

But your discount brings it down by TWO-THIRDS…

This is something I’ve arranged personally with Keith, just for Fat Tail customers.

And it’s a way to get you access to this individualised stock tracking and monitoring software at a price that’s not going to break the bank…

Actually, it’s the best price you’ll see for TradeStops Pro — anywhere in Australia.

But it’s a limited time offer — and only available through this invitation

Look, you don’t need to make your mind up right now because there’s more to come.

But keep an eye out for that button and if you want to add TradeStops Pro to your investing arsenal, click on it when it appears, and we’ll help you get started.

Now, Keith, I want to talk to you about another key feature of TradeStops Pro…

And actually, I think this one could seal the deal for many of our subscribers…especially our Alliance Members.

It’s the position sizing tool.

Can you tell us what it does?

KEITH

Sure. So this is where TradeStops Pro can help people make investment decisions that are more personal to them.

And one of the biggest problems most investors have is deciding how much money to invest in any one stock.

Now as you’ve said Woody, that’s not something your business is able to suggest to subscribers.

But obviously it’s a hugely important issue…

So, to address it, we created a tool called the ‘position size calculator’.

And it was designed to help investors answer that specific question:

How much money should I

invest in each stock I own?

Now people might think this is a straightforward question.

If you have $10,000 to invest in five stocks, just put $2,000 in each and you’re done.

But remember, Woody, no two stocks are the same.

Some are way more volatile than others.

And in the event of a crash, these riskier stocks can have a much bigger negative impact on your overall portfolio.

We call that ‘asymmetric risk’ — the potential to create an unmanageable loss…

And what the position size calculator does is help you guard against it.

To give you a simple example, let’s look at Tesla and Apple again.

Two great stocks. You probably want to own both. But they’re actually two very DIFFERENT stocks.

So…if you had $10,000 to invest in these companies, would you put $5,000 in each?

Some people would.

But YOU wouldn’t — IF you were using the position size calculator — and here’s why…

So what it does first is look at the VQ of each stock.

In our example, let’s say Apple has a VQ of 24%…

And Tesla’s VQ is 50%…which, actually, is not too far from where they typically sit.

Now remember, my goal as an investor is to maximise returns and minimise risk — across my overall portfolio.

So the position size calculator has been designed to give me the ‘optimal’ amounts to invest, with that goal in mind, based on my $10,000 budget.

And what it comes out with, in our hypothetical example, is to invest $3,200 into Tesla, the more volatile stock, and $6,800 into Apple.

That way I can equalise my risk

across both positions

Now what do I mean by ‘equalise my risk’?

Well, remember, Tesla has a hypothetical VQ of 50%.

- If I put $3,200 in Tesla and it goes down, the MOST I’m going to lose is $1,600…because I’m using the VQ of 50% as my stop-loss.

- And I know with Apple, because its VQ is 24%, if I invest $6,800, the most I’d stand to lose is the same — about $1,600.

So I’ve balanced my risk.

In other words, my potential loss is the same for BOTH stocks.

And because Tesla is the more volatile stock…by only investing $3,200, if it suddenly tanks, it doesn’t create an unmanageable loss for me.

But if it goes up dramatically, it will still give me big upside.

WOODY

This is something our subscribers are going to absolutely LOVE, Keith…

…I’m thinking particularly about our Alliance members, who may own several stocks across a number of different Fat Tail services.

This is going to simplify their lives to a HUGE degree!

I mean, to be able to enter in the stocks you want to buy…and your total investment…

And then get a number for each stock…

It would solve so many problems for our subscribers.

KEITH

Well, that’s exactly what it’s been designed to do!

TradeStops Pro can suggest how much to buy of any given stock

It can show you where to set your stop-losses…

And how to equalise your portfolio so that you’re not exposed to ‘asymmetric’ risk.

And Woody, it takes care of ALL of this for you…

…you upload your Fat Tail portfolio to TradeStops Pro, tell it what you want, how much you’ve got to invest, and it does the heavy lifting.

And it doesn’t matter if you have two stocks…or 10 stocks…or even 100 stocks.

Whatever your situation, TradeStops Pro will help you determine how much to invest in each position…when to sell…when to buy back in…

…AND how much you stand to lose on any given stock, should the worst happen.

And very quickly, there’s ANOTHER tool in TradeStops Pro I want to tell you about…

It’s called the ‘Risk Rebalancer Tool’…and it can help investors equalise their risk across their EXISTING positions…

WOODY

So you’re talking about established portfolios, right?

…stocks that subscribers may have held for a while — and plan to own over the long term?

KEITH

Exactly.

TradeStops Pro can show you how to tweak your existing holdings…to manage your exposure to unexpected volatility…

And reduce the danger of ‘asymmetric risk’ in the stocks you already own

Our ‘Risk Rebalancer’ tool will show you how to equalise your risk across all the stocks you currently hold…

Based on the ‘VQ’ of each stock, and the size of your holdings.

So it may suggest a tighter or wider stop-loss than you currently have…

And it may suggest you take a smaller or larger position based on the volatility in that stock, relative to the other stocks you own.

Again, we’re trying to simplify people’s investing lives…and give them greater peace of mind when making these big decisions with their money.

We want to help people get an instant handle on their stock portfolio…

To limit their capital risk…to know what they’re shooting for on the upside…

And to always know what they stand to lose, should the worst happen.

Be clear: TradeStops can’t reduce the volatility in individual stocks.

That just is what it is.

But we CAN help you manage your exposure to that volatility in a way that maximises the potential upside…while limiting your losses in the worst-case scenario.

WOODY

Now again, I want you to think about the CONFIDENCE that would give you to make important decisions about where and how to invest your money…especially in this turbulent market.

Think about it…

No more guessing.

No more overreacting to market events.

No more crossing your fingers

and hoping for the best

You’d be getting the kind of insight people pay professional money managers TENS OF THOUSANDS of dollars a year for…

…but for a tiny fraction of the cost.

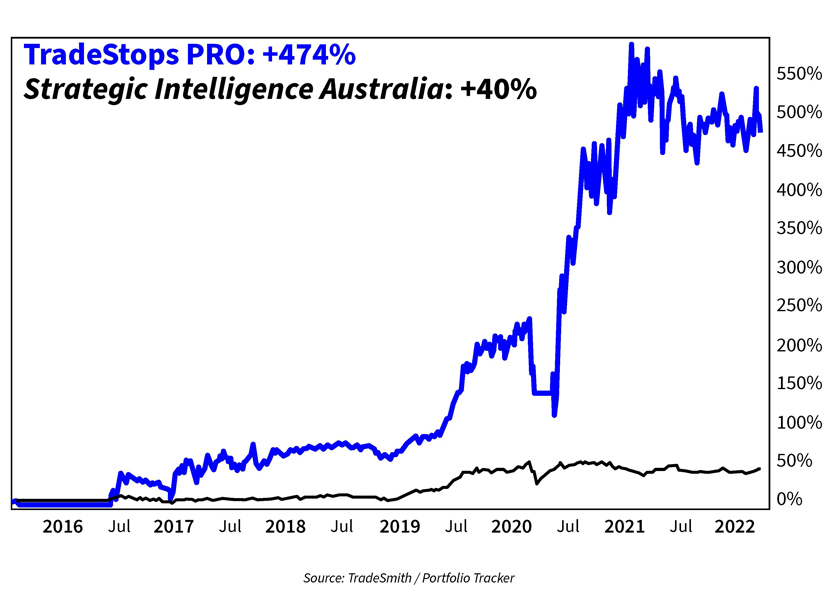

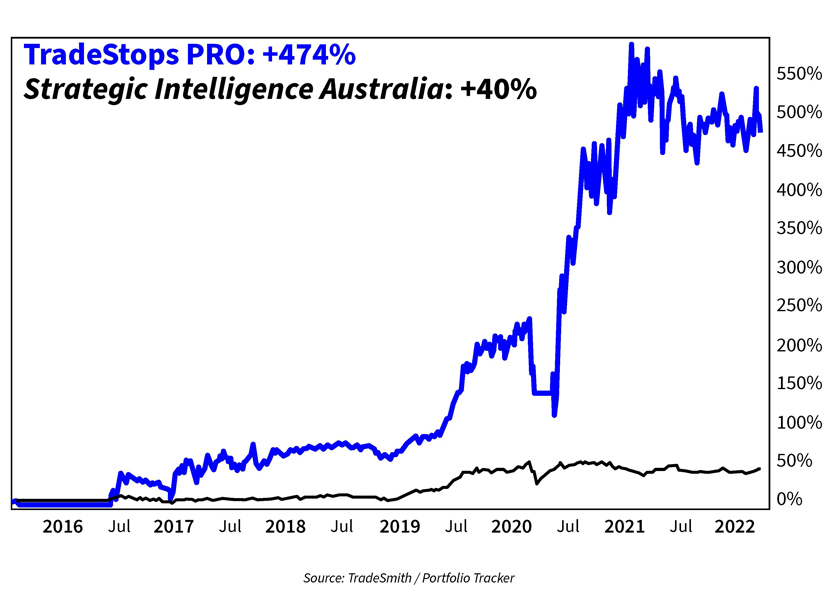

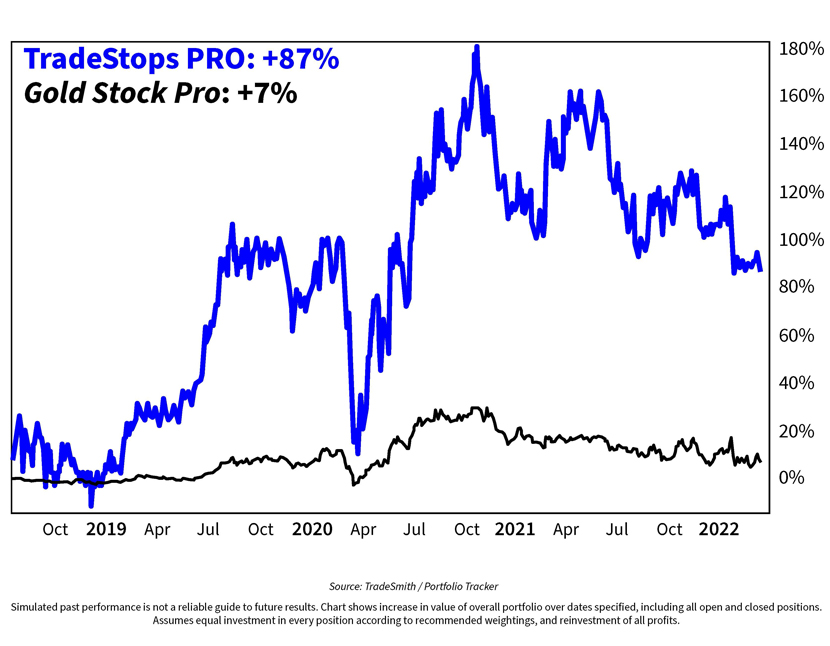

And to remind you, in backtesting, THIS is what TradeStops Pro achieved when we applied it to our Fat Tail service portfolios, across all open and closed positions…

And look, we’ve been clear throughout today’s presentation that these results we’re showing you are the product of backtesting.

We can’t guarantee a similar outcome in the future…

…because firstly, there’s no guarantee the signals will always be right…

And secondly, your success will depend on how quickly you’re able to act on the signals.

But my goodness…it certainly makes you think, doesn’t it?

Imagine achieving results like these, without using leverage of any kind: no options, no CFDs, and no new stocks

Interested?

Well, let me remind you that, right now, you can take TWO-THIRDS off the official price of an annual subscription to TradeStops Pro — including all the tools and features we’ve talked about today.

This is an exclusive offer — just for Fat Tail subscribers.

You won’t find a cheaper price for TradeStops Pro anywhere else in Australia.

But it’s only available through THIS invitation…and only for a limited time.

I’ll give you all the details in a moment.

But remember, you can scroll down, click on the button at the bottom of this letter at any time to get started — and Keith’s team will take care of you.

From there, you’ll be shown how to set your account up, how to upload your stocks and portfolios, how to set up all your alerts, and much more.

And as I say, you can even take advantage of a 1-on-1 setup session with a TradeStops Pro ‘concierge’, to get you up and running even quicker.

Everything has been carefully designed to make this work for you

Not to bamboozle you or frustrate you.

It’s quick, easy, and professional.

And if the results you get are anything like what we’ve seen in backtesting, you’re going to be very happy you gave this a go.

As Keith B says:

‘The markets today are psychotic, but TradeStops helps keep me calm and keeps me from “running to cash”. I always consult TradeStops before entering a new position…I plan to use it for the next 30 years.’

Peter B writes:

‘Not utilizing TradeStops would be the single biggest mistake you could make! It is an absolute necessity if you expect to be able to manage a sizable portfolio efficiently.’

And Leroy S says:

‘Start using [TradeStops] immediately. Having first-hand experience as to what can happen when you entrust your investments to others, I would beg, plead, implore anyone invested in or thinking about investing in the markets to start using [TradeStops] immediately.’

Click on the button at the bottom of this page if you want to add TradeStops Pro to YOUR investing toolkit…

You’ll go through to a page where the TradeStops team will look after you.

Keith and I will still be here, but not for much longer — we’re getting ready to wrap things up…

But before we do, Keith, there’s something else you want to tell us about, isn’t there?

KEITH

Yes…it’s another tool inside TradeStops Pro and it’s called ‘Pure Quant’.

It’s a fully optimised portfolio builder, essentially.

In fact, I call it the ‘holy grail’

of portfolio building

So you give Pure Quant a whole bunch of stocks, funds, ETFs — whatever you like…

You tell it how many positions you want, and how much money you have to invest.

And in roughly one minute…Pure Quant will analyse all the stocks you give it…

And then show you a model portfolio of the healthiest stocks…that are already in an uptrend…

Organised in a diversified way…

With your capital risk equalised across the entire portfolio.

Woody, you could feed 5,000 stocks into Pure Quant — with no idea of what to buy…

And within a minute or two, you’d have a portfolio of 10 or 20 companies that are already in an uptrend…

Pure Quant would help you determine the exact stocks to buy in the right proportions to each other and how much money to put into each one.

WOODY

So what if I said: ‘Here’s every stock on the ASX…

‘Tell me how to put $100,000 to work on, say, 10 positions…’

KEITH

You’d have that portfolio that you can model inside of your own account within minutes…

And the software wouldn’t

even break a sweat!

Same if you wanted to build a portfolio of gold stocks.

You could feed every gold explorer and producer on the ASX into Pure Quant, and within a minute you’d know what to buy, how much to spend, and what your overall risk was.

Same with tech stocks…green energy stocks…small-cap miners…whatever you want.

You can even use Pure Quant to track what billionaires are doing with THEIR money…

So, for example, you could ask Pure Quant to copy what Warren Buffett does but tailored to your own capital pool and risk tolerance.

WOODY

This could be a Godsend for our Alliance members…

KEITH

Absolutely.

Let’s say you’re an Alliance customer…and you have $10,000 to invest…or $100,000…or even a million…across all your fat tail positions.

But…you only want to own 20 stocks.

You can tell Pure Quant to look at every single current stock recommendation from every Fat Tail service…

And it will show you, in roughly one minute…

20 ‘Fat Tail’ stocks in an uptrend, that best fit your criteria…

How much to invest in each one in order to equalise your risk…

And where to set your trailing stop on each stock relative to its VQ.

WOODY

Are you getting this, Alliance members?

Let me spell this out for you — because I think this is a game changer…

It’s something that could really complement the work Murray does with the Fat Tail Capital Solution model portfolio…

If you’re still not sure of the 20…or even the 10…best Fat Tail stocks to buy from the hundreds of current open positions we have…

Pure Quant will not only help you figure out which ones to buy…

It will also suggest how much to invest in each position, based on the VQ of each stock, and your capital pool…

And it will show you the best place to set your stop-losses…

With the aim of maximising your gains and reducing your exposure to ‘asymmetric’ risk.

And all in the space of

JUST ONE MINUTE

Don’t believe me?

Go and check it out for yourself!

Pure Quant is included in your TradeStops Pro membership today…so if you click the button below, you can go through and give it a try.

Right, Keith, we’re almost there…

This has been a really impressive presentation so far — and we’ve seen some excellent results from the backtesting.

Of course, we know this isn’t going to be for everyone.

We can’t guarantee it’s going to be 100% right on all of your stocks, all of the time.

And some people might have misgivings about using a software app…

But for those watching who ARE interested, and keen to give TradeStops Pro a try, how can they get started…and start putting these tools to work on their stocks?

KEITH

It’s simple.

Just click the button at the bottom of this page and you’ll go through to our website where we’ll process your order and get you all set up.

You’ll be able to upload all the Fat Tail services you subscribe to, right away…

As well as any other stocks you currently own…and any you want to watch.

The process takes just a few minutes…

And if you get stuck, there’s a step-by-step video tutorial on our site to guide you through it.

Now, to be clear:

You DON’T transfer any of your investment capital to us

We’re NOT brokers or money managers.

In fact, you don’t need to change your broker at all.

You’ll transact as normal, through your regular platform, there in Australia.

TradeStops Pro only works with data, so that’s all you need to give us.

And we hold that data securely on our server.

OK…so when you’re finished uploading your stocks and portfolios, you’ll have access to: the Volatility Quotient (or VQ Score)…

So you’ll get dynamic stop-loss alerts on all your Fat Tail stocks, based on their expected volatility.

And that will help you make rational, data-driven, and hopefully BETTER decisions on when to sell or keep hold of any stock.

You also get access to the Health Status Indicator…and that will tell you which stocks in your Fat Tail portfolios are red, yellow, or green.

You may decide that you want to fill your portfolio with green stocks only.

I think that’s a good decision, but it’s your call.

The good thing is, if the VQ is suggesting that it’s a good time to consider getting OUT of a position…

The health tool will help you determine when it’s a good time to buy back IN.

You’ll never have to guess…and you’ll never have to give up on stocks that you like for the longer term

Next, you’ll get access to the Position Size Calculator — and this will suggest how much to invest in each stock you own, based on its VQ score, and your total capital base.

The aim, as we said a moment ago, is twofold…

- First, to make sure you don’t put too much of your money into overly volatile stocks…

- And second, to help you spread your capital risk evenly across your entire portfolio.

Next, you get the Risk Rebalancer Tool, which will quickly analyse the VQ of every stock in your existing portfolio…

…and show you how to reallocate your capital to the less risky positions you hold.

Again, the aim is to make sure that your risk is evenly spread…and that you don’t overcommit to any one stock — no matter how much you love the company.

And you’ll also get the Pure Quant Portfolio Builder, which lets you run as many companies as you like through all of our tools at the same time…

…and within a minute, get an optimised, risk-balanced model portfolio of stocks that are all in an uptrend.

Pure Quant will help you choose which of these stocks to buy and how much to invest in each one.

WOODY

Thanks Keith.

You know what? Under the circumstances…with conditions as they are right now…

…I think what you’ve just described could have a huge impact…not just on WHAT people invest in, but on HOW they invest too.

Just having that peace of mind…that confidence to make decisions at difficult times…I just think our subscribers are going to find that really valuable.

KEITH

Well thanks, Woody, we certainly think so.

And you know, a lot of the biggest problems investors face really are just information problems.

That’s why most of us react to what’s happening in the market.

We don’t REALLY know what’s happening…or what the consequences are likely to be…because there’s a shortfall in our knowledge.

What TradeStops does — to the best of our ability and computing power — is make up for that shortfall.

And that means you’re less likely to ‘react’ to the market…

…and more likely to get ahead of it — and do the kinds of things we’ve shown you today:

- Avoid big crashes…

- Buy back into stocks that are rebounding…

- Equalise risk across your portfolio, and so on.

And I happen to agree…

There’s never been a better time to get this kind of help than right now

We’re refining TradeStops Pro all the time…adding more benefits and making it even easier to use…

For example, we’ve got something called The Newsletter Center…

Where you can view any open recommendations from the newsletters and services you follow…and filter them through the TradeStops Pro tools.

This can help you adjust your holdings, tweak your stop losses, re-balance your risk, and more.

We’ve also got a feature called Billionaire Portfolios…

And what this does is track the buying and selling activity of 27 of the world’s billionaires.

Last I checked there were close to 2,000 stocks in there — of all kinds.

So TradeStops Pro can tell you exactly which billionaire is buying what stocks…

And then it tells you which stocks are red, yellow, or green.

In other words, you can ‘piggyback’ what these billionaire investors are doing — tailored to your own capital base, of course…

In fact, you could conceivably do BETTER than them, because you can choose to only buy the stocks that are green!

WOODY

OK, so those two additional features add to the HUGE value you already get from your TradeStops Pro membership…

…which, by the way, is covered by a generous 90-DAY satisfaction guarantee, provided by Keith’s company.

Now 90 days is three months, pretty much.

So that gives you plenty of time to have a good look at the TradeStops Pro platform…

Import your portfolios…

Add some stocks…

Balance your overall risk exposure…

Set new stop-losses…

And put all the tools to work

on YOUR investments

It’s also plenty of time to see the results of this software and make up your own mind as to its value.

And if you DON’T get the results you’re expecting…

And you CAN’T see the value in your TradeStops Pro subscription…

Contact Keith’s team by email or phone at any time in the next 90 days…

And they will cancel your membership and issue you with a credit that you can use against any other TradeStops Product or service.

Remember, TradeStops Pro is NOT a Fat Tail product.

Personally, I wish it was because it’s so good!

But when you place your order today, you’ll do so through Keith’s team in the US.

Now, to be clear: we’ve worked with Keith for years and we FULLY support his business.

To be honest, I’d be amazed if TradeStops Pro didn’t change your life for the better.

But I do understand that some people are a bit wary of technology…and maybe that stops them from getting the most out of something like this.

So Keith, how can your team help people who aren’t really tech savvy?

KEITH

Well the good news Woody, is that…

You don’t have to be tech savvy

to use TradeStops Pro

Not at all.

You don’t even need to have lots of investing experience.

The key thing I want to get across to people is that we want this to work for you.

We want you to get better results from your investing. That’s why we’re in business!

As CEO it is my number one goal to have satisfied customers — and that starts with a great user experience…from day ONE.

So, next week, Greg Canavan from Fat Tail will join Marina in our onboarding team for an introductory webinar, that will be exclusive to our new Fat Tail members.

Greg obviously knows your services and your experts, and your people way better than we do.

So he’ll be able to help tailor that onboarding session for an Australian audience and a Fat Tail audience.

So that’s something to look out for right away.

You’ll also find, when you log in to TradeStops Pro, that you have access to EIGHT tutorial videos.

These are all very specific and answer most of the set-up questions we get asked.

Including:

- How to import your portfolio to the website…

- How to set up stock alerts…

- How to rebalance your portfolio to minimise risk…and so much more.

Basically, everything you need to get the most out of your subscription…with no unnecessary friction or teething issues.

Then, every week for the first six weeks of your membership you’ll have access to a twice-weekly video tutorial series run by Marina in our training team.

We call it our ‘onboarding bootcamp’ and it will walk you through how to get up and running with TradeStops Pro in real time.

All the sessions are recorded, so you’ll be able to go back and revisit them, pause, skip sections, whatever helps.

And then — one of the biggest benefits to new members — is that you’re entitled to a 1-on-1 onboarding session with a TradeSmith concierge.

This is a personal resource only ‘Pro’ level members and above can tap into

All you need to do is organise a time with one of our concierges and they will walk you through TradeStops Pro, in person.

Yes, it may be early in the morning for you, and later in the evening for us…or even vice versa…but we’ll make it work!

And our concierges are extremely knowledgeable.

So while they can’t give you personalised investment advice, please ask them anything about the software, no matter how small or insignificant you think it is.

WOODY

I think that’s a great benefit Keith.

There’s nothing quite like the personal touch. And I think making the effort to help people get set up and comfortable with the tools and the platform will make a big difference.

And listen, I want to say thanks for going over all the benefits of the TradeStops Pro package with us today.

It’s clear that you’ve put a lot of thought into addressing some of the biggest questions our subscribers will have.

But just one question remains…

What will people pay today to get access to TradeStops Pro?

KEITH

Well Woody, let me just say that I believe there’s nothing out there like TradeStops Pro.

Yes, you can buy financial and market data packages, like the Bloomberg Terminal Subscription you mentioned earlier.

But that costs $24,000 US dollars a year.

And as good as it is, it can’t do what TradeStops Pro can do.

There’s no VQ, Health Tool, Position Sizing Tool, Risk Rebalancer, or Pure Quant…

You have to apply your own analysis to the Bloomberg data if you want to make the kinds of important investment decisions TradeStops Pro can help you with.

And remember, we showed you — albeit in backtesting — how those decisions could have helped you outperform each of the Fat Tail service portfolios we analysed.

Now I know that our results are only hypothetical.

And, of course, we can’t make any claims or promises about the future.

But Woody…

TradeStops Pro beat EVERY

single Fat Tail portfolio we went

up against…that’s not a fluke!

The point is, why would you spend $24,000 a year on a Bloomberg terminal…

When TradeStops Pro can potentially help you solve so many investing problems…

— not just provide data —

For a tiny fraction of the price?

And that price, Woody, is just $3,000 US.

That’s EIGHT TIMES LESS than a Bloomberg subscription…

And it gets you 12 months access to TradeStops Pro, including ALL the tools we’ve talked about today.

However…

Woody, you, and I have struck a deal for Fat Tail customers — and it’s actually one of the most generous deals I’ve ever made.

So…if you like what you’ve seen today…

And you want to put TradeStops Pro to work on YOUR stocks…

You will pay just $999 US for your annual membership.

That’s TWO-THIRDS off the regular joining fee.

And I’m going to lock that rate in every year, for as long as you see value in your subscription.

Now this is the lowest price we offer to new members for a year’s subscription to TradeStops Pro — anywhere in the world.

But it’s not going to be

on the table for long

For starters, I just can’t afford to keep the doors open for more than a few days at that price.

But also, we’ve found that most investors tend to see the value in TradeStops Pro very quickly.

They understand what it can do, and how it could help them invest with greater confidence…and home in on better results…from the get-go.

This isn’t really a decision you have to spend days agonising over.

And frankly, in this market, you don’t have the luxury of time anyway!

That’s why we’re limiting the offer.

It’s only going to be available for a few days…and only through THIS invitation.

So if your mind’s made up — don’t hesitate…

Scroll down. Click the button at the bottom of the page now and my team will look after you from there.

WOODY

Just be clear: your membership to TradeStops Pro is charged in US dollars — not Aussie.

When you click the button, you’ll go through to a secure page on the TradeStops website where Keith’s team will take care of you.

Remember, TradeStops Pro is a partner product — it’s not part of Fat Tail Investment Research.

But we’ve worked together for years, which is why we’ve been able to negotiate a great deal for you.

So please, hurry, because as Keith says, this is a limited-time offer, and it may be pulled offline without notice.

OK Keith, I think we’re about done.

Any final words before we let you go?

KEITH

I would just urge everyone watching to really think hard about their investment goals over the next year…

And think about the level of risk and uncertainty in the market right now.

We can’t take that away completely for you…

But what we CAN do — through our software platform — is give you the ability to make big investment decisions with greater confidence than if you were reacting to the market, along with everyone else.

Remember, TradeStops Pro can help you decide what to buy…how much to buy…when to sell…and when to buy back in…

All according to your investment goals.

These are problems Woody’s team can’t solve directly for you.

And it doesn’t matter to us whether you have $10,000 to invest or 10 million.

Use TradeStops Pro to guide your investing decisions and you can shoot confidently for better results…without buying any new stocks or taking on unnecessary extra risk.

WOODY

Nicely put!

Keith, thanks for being with us today.

You’ve made an excellent case for TradeStops Pro

I just think it’s money well spent

in the current climate

KEITH

Well, I think so too — but I’ll leave that up to your subscribers to decide!

In any case, thanks for having me Woody and thanks to everyone at home in Australia for joining us.

WOODY

OK…we’ve shown you what TradeStops Pro can do…so now it’s over to you.

If you want to put TradeStops Pro to work on YOUR stocks, don’t hesitate; click the button at the bottom of the page right now

Remember, most people pay $3,000 US for an annual subscription…

But if you’re quick, and you respond through THIS invitation, you’ll only pay $999…

AND you’ll get to lock that price in every year — as long as you remain a subscriber.

It’s an incredible offer — TWO-THIRDS off the regular price!

But, as Keith said, they can’t keep it open for long…

So if you’ve made your mind up, don’t put this off. Click the button at the bottom of the page now and Keith’s team will look after you from there.

From all of us here in Melbourne, take care and see you soon.

Sincerely,

|

James Woodburn,

Host, Invisible Edge 2022

CLICK THE BUTTON BELOW NOW to add TradeStops Pro to your investing arsenal and take TWO-THIRDS OFF the regular price — for a limited time only…

You can review your order on the next page before committing to buy